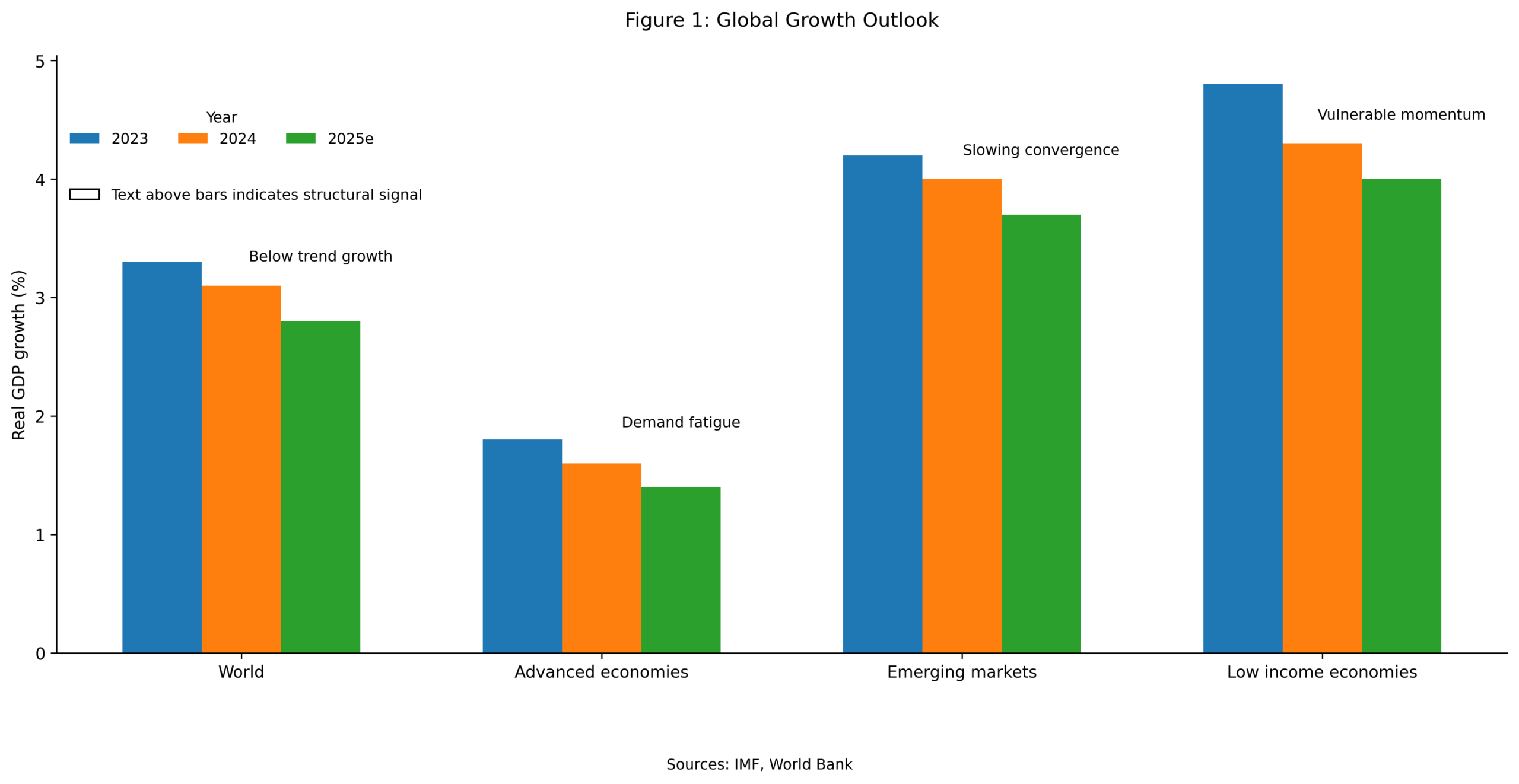

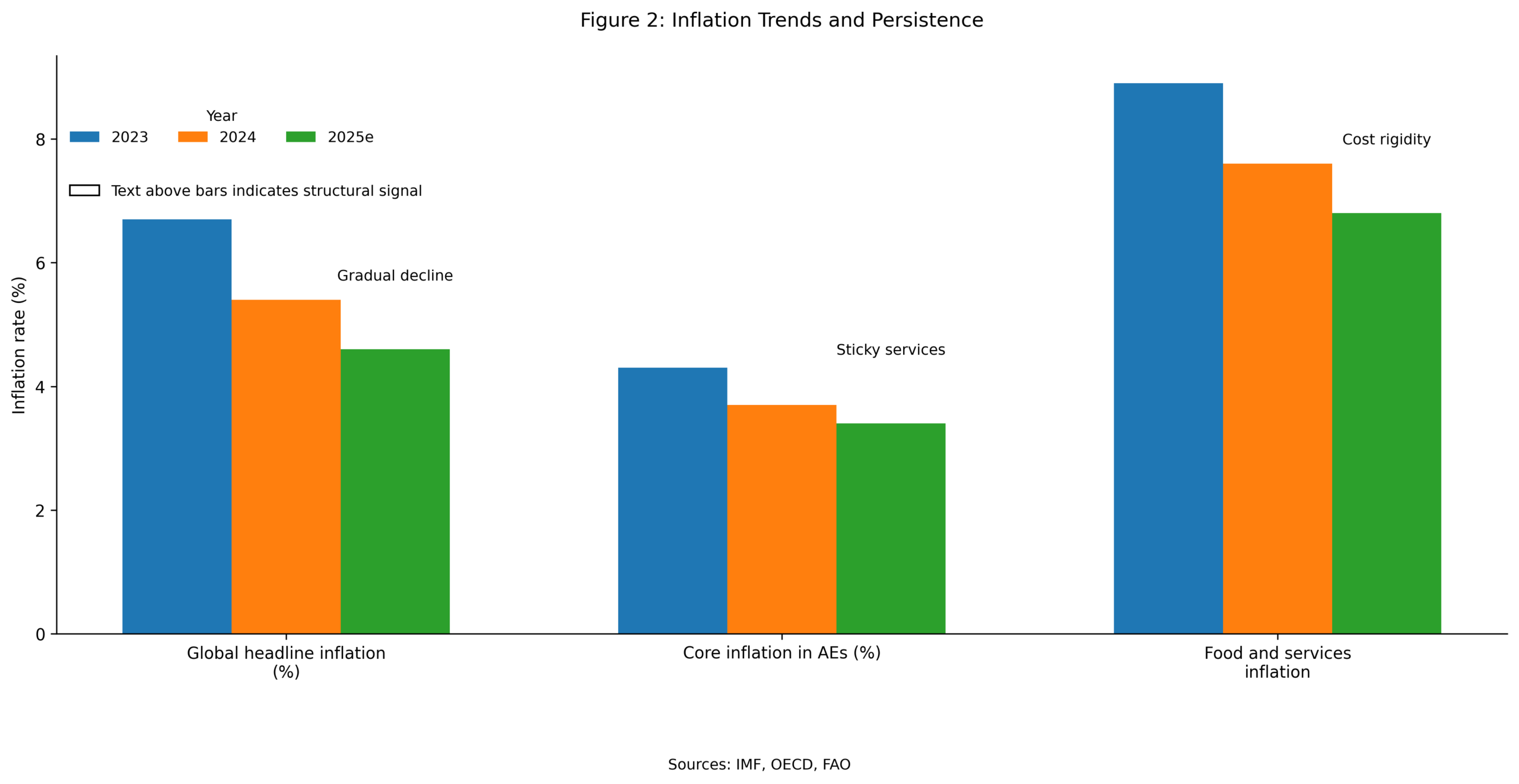

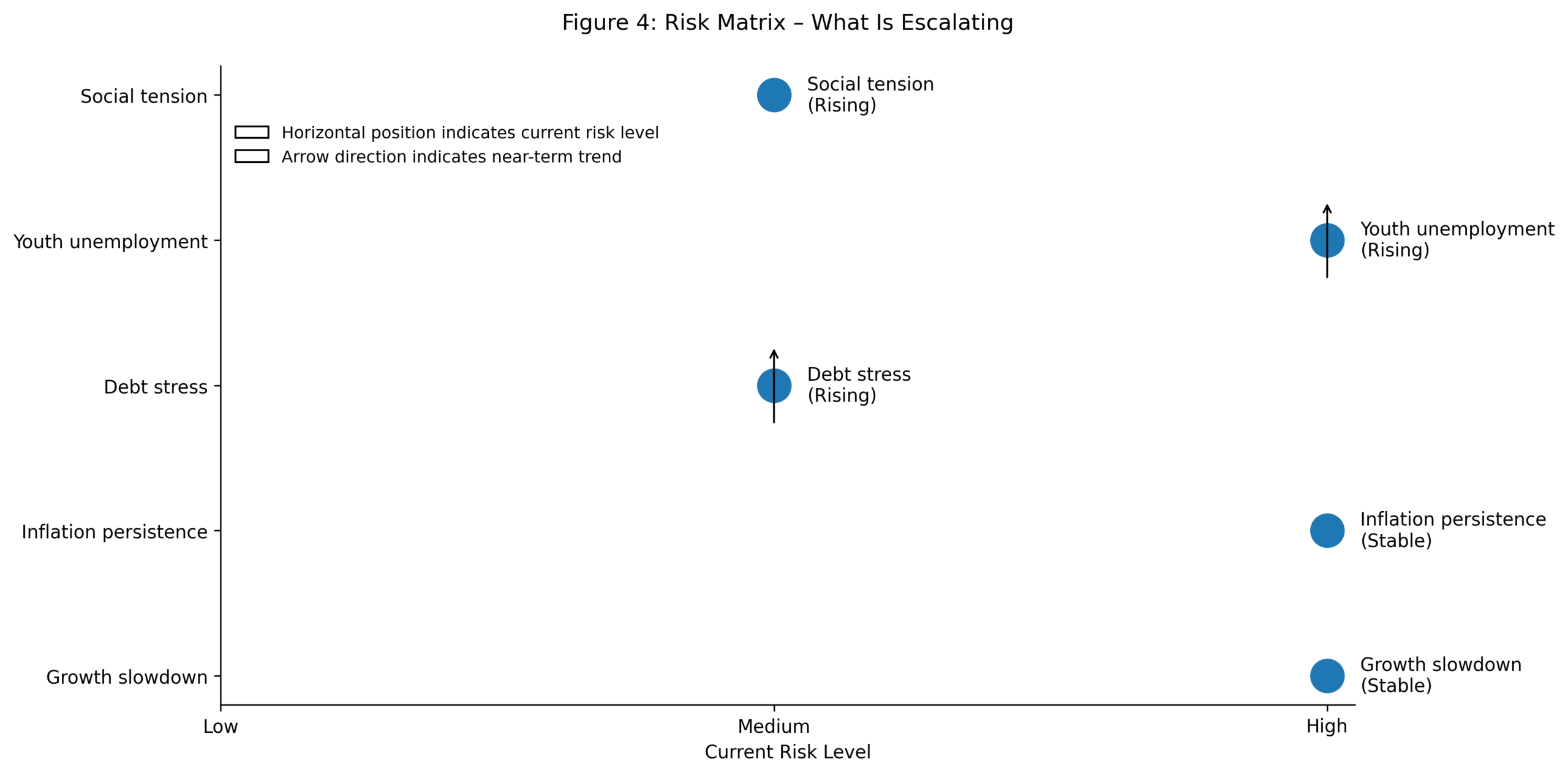

Slow growth and sticky inflation are increasingly defining the global economic environment as 2025 comes to a close. Unlike earlier cycles, weak growth is no longer delivering rapid disinflation. Instead, inflation persistence is unfolding alongside slowing output, rising public debt, and labor market strain. As a result, traditional adjustment mechanisms have weakened. Moreover, slow growth and sticky inflation are interacting with demographic pressure and technological disruption, raising long-term risks to productivity and social stability.

Executive Snapshot: Slow growth and sticky inflation

Slow growth and sticky inflation have shifted from a cyclical challenge into a structural macroeconomic condition. Growth momentum remains weak across major economies, reflecting subdued investment and productivity. Inflation pressures persist despite tighter monetary conditions. At the same time, rising public debt constrains fiscal flexibility. Labor markets show growing stress, especially among younger cohorts. Consequently, economies face weaker growth potential, higher volatility, and rising social risk.

Key Numbers: Institutional Fragility and Regional Spillovers

- Global GDP growth in 2025 projected below 3 percent

- Over 60 percent of economies report inflation above target

- Global public debt exceeds 95 percent of GDP

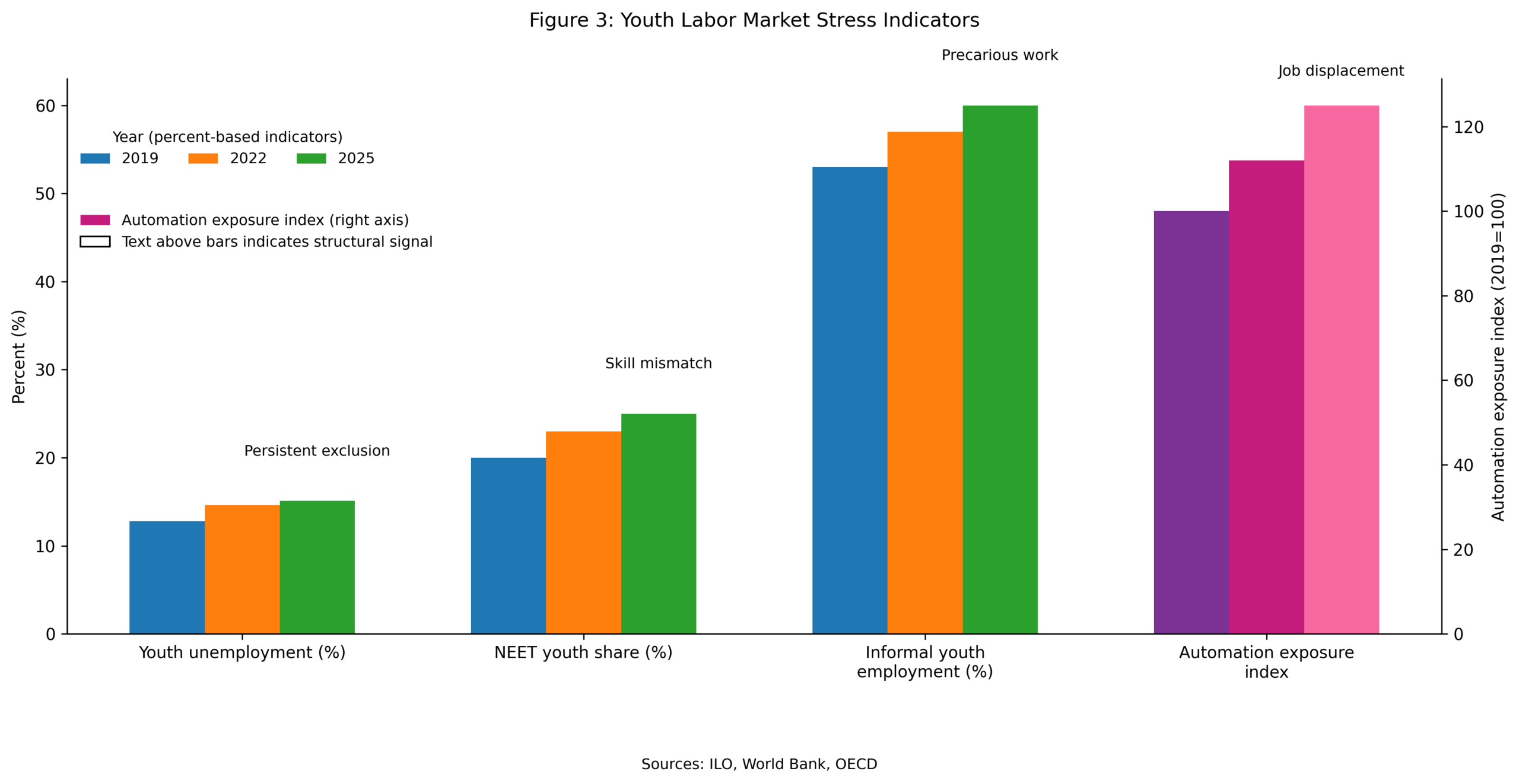

- Global youth unemployment near 15 percent

Fragile States and Economic Spillovers as a Global Signal

Slow growth and sticky inflation are reinforcing each other through multiple channels. Weak demand has failed to produce rapid price normalization. Instead, services inflation, energy volatility, and trade fragmentation continue to support price pressures. Medium-term outlook assessments confirm that growth projections are softening even as inflation expectations remain elevated https://economiclens.org/global-economic-outlook-2025-2026-slow-growth-sticky-inflation-rising-debt/.

Trending global signals reinforcing this pattern include subdued recovery in the euro area, China’s property-led slowdown, and supply risks linked to Red Sea shipping disruptions.

Governance Breakdown and Growth Instability under Weak Growth and Persistent Inflation

Growth is slowing across income groups. Advanced economies face tight financial conditions. Emerging markets face capital constraints. Low income economies remain shock exposed. These trends confirm that slow growth is broad based and persistent.

Inflation Persistence Across Regions

Inflation is easing slowly but remains above comfort levels. Core inflation remains sticky. Food and housing costs anchor expectations. This explains why slow growth has not delivered fast disinflation.

Debt Overhang and Fiscal Stress

Public debt has risen sharply across advanced and emerging economies. Higher interest rates have increased debt servicing costs. Meanwhile, slower growth reduces revenue generation. As a result, fiscal policy space is narrowing.

Debt dynamics amplify slow growth and sticky inflation. Fiscal consolidation suppresses demand. Expansion risks credibility. These tensions increase vulnerability to shocks https://www.imf.org/en/Topics/debt

Trending pressures include rising sovereign refinancing risks in emerging markets and tighter global financial conditions.

Global Youth Unemployment Pressure under Weak Growth and Persistent Inflation

Labor market adjustment lags behind economic and technological change. Youth exclusion weakens income formation. Skill mismatches slow productivity growth https://economiclens.org/global-youth-unemployment-2025-ai-disruption-skills-gaps-the-gen-z-jobs-crunch/.

AI Driven Labor Disruption under Weak Growth and Persistent Inflation

Artificial intelligence adoption is accelerating across sectors. However, short-term displacement risks dominate. Firms automate faster than workers retrain. As a result, youth underemployment rises, especially in economies with weak training systems.

Global labor assessments show skills gaps widening rather than narrowing https://www.ilo.org/global/topics/youth-employment/lang–en/index.htm

Trending signals include AI-driven job losses in clerical services, retail automation, and platform-based work expansion.

Cost of Living Stress and Social Risk in Fragile States and Economic Spillovers

Sticky inflation affects households unevenly. Food, housing, and services remain expensive. Younger workers face disproportionate pressure. As real wages stagnate, dissatisfaction grows.

Central banks face constrained choices. Further tightening suppresses growth. Early easing risks inflation expectations https://www.imf.org/en/Topics/inflation.

Stagflation Era Risks Over the Next 12 Months

- Baseline scenario: Slow growth persists with gradual inflation moderation.

- Downside scenario: New supply shocks reignite inflation amid weak growth.

- Upside scenario: Productivity gains and labor reforms ease pressure unevenly.

- Expert Insight: Institutional Views on Growth and Inflation

Expert Insight: Institutional Views within the Political Economy of Fragility

Global institutions increasingly converge on the view that slow growth and sticky inflation represent structural risks.

The IMF highlights inflation persistence and debt sustainability challenges https://www.imf.org/en/Topics/inflation.

The World Bank warns that weak growth and high debt constrain development https://www.worldbank.org/en/publication/global-economic-prospects.

The OECD emphasizes labor disruption and productivity slowdown risks https://www.oecd.org/employment/

Bottom Line

Slow growth and sticky inflation are no longer temporary frictions. They reflect structural constraints linked to weak productivity, debt overhangs, and labor market disruption. Without sustained productivity gains and effective labor adjustment, slow growth and sticky inflation will remain defining features of the global economy through the second half of the decade.

1 thought on “Slow Growth and Sticky Inflation”

I do consider all of the ideas you’ve presented on your post. They’re very convincing and will certainly work. Still, the posts are too quick for novices. May you please prolong them a little from next time? Thank you for the post.