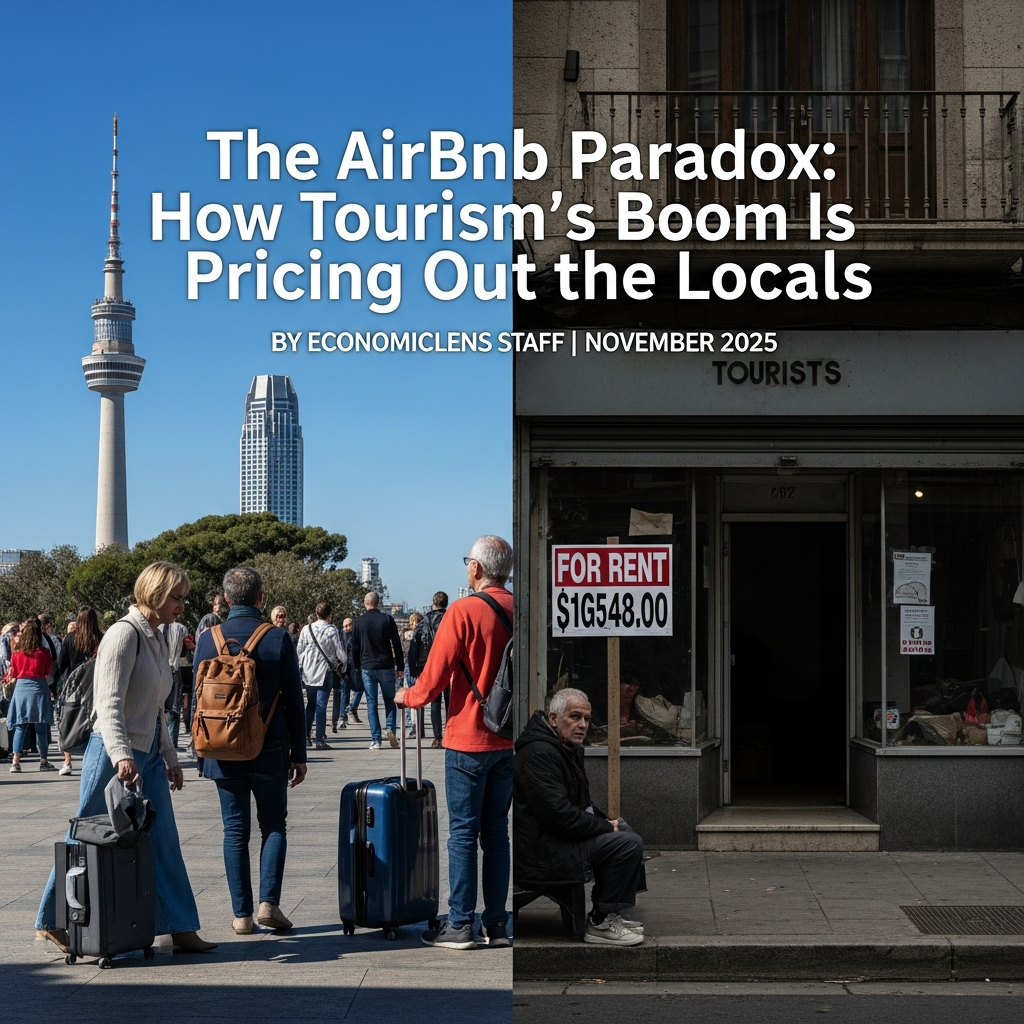

Explore how the booming tourism industry, driven by platforms like Airbnb, is reshaping cities in 2025. Learn about the Airbnb Paradox, Tourism Boom and Housing Crisis, and their impact on housing, affordability, and sustainability.

“Behind the glossy travel economy lies a housing crisis reshaping cities from Lisbon to Bali”

-

Executive Summary : The Airbnb Paradox- Tourism Boom That Turned on Its Hosts

By 2025, 25% of houses in central Lisbon and over 40% of apartments in Barcelona’s Gothic Quarter were available on short-term rental platforms such as Airbnb and Booking.com (UNWTO, 2025). What started as a lifeline for pandemic-impacted tourism has transformed into a housing problem for local residents whose neighborhoods, once welcoming to tourists, are now dominated by short-term rentals. The Airbnb impact on housing has become a critical issue, as local communities face displacement.

The post-COVID rebound fostered optimism in economies and restored millions of jobs; but it also accelerated a discreet displacement as city centers evolved into temporary lodgings. Cities ranging from New York to Bali, which have welcomed “revenge travelers,” are now contending with rising prices, decreasing housing availability, and declining community life (OECD, 2024; World Bank, 2025). Tourism growth and housing shortage have become intertwined, as the influx of tourists has outpaced the capacity to provide affordable housing. Tourism, once framed as a clean engine of growth, now embodies the contradictions of the digital economy: efficiency without equity and innovation absent inclusivity.

This blog examines the challenge via eight interconnected aspects — recovery, overload, housing crises, global ripple, citizen movements, research insights, and policy trajectories — to assess whether cities can welcome the world without losing themselves in the face of the Airbnb impact on housing and tourism growth and housing shortage.

“Every guest needs a host — but what happens when the hosts can no longer afford to stay?”

-

From Recovery to Overload — The Post-Pandemic Travel Rebound

Following the restoration of international borders in late 2022, “revenge travel” swiftly converted airports into overcrowded centres and city centres into extensive lodging facilities. The number of global visitors rose from 917 million in 2022 to 1.3 billion in 2024, reflecting a little 6 percent decrease from the pre-pandemic record (UNWTO, 2025).

The revival manifested as resilience: tax revenues rose, restaurants rehired personnel, and GDPs grew (IMF, 2024). Yet, the infrastructure behind the boom — housing, utilities, and communities — remained inadequate. The Airbnb paradox has accelerated the shift as homes were converted into listings, turning local neighborhoods into temporary lodging hubs, a core issue of the tourism boom and housing crisis.

Sustainable housing faces challenges as short-term rental platforms like Airbnb have expanded 65 percent more swiftly than hotel capacity, diverting visitor spending into residential real estate and constraining housing supply in key destinations. The Airbnb paradox continues to push housing prices upward, further deepening the tourism boom and housing crisis in cities worldwide.

The following data track how international travel and lodging demand outpaced housing capacity worldwide.

Sources: UNWTO (2025); OECD (2024); World Bank (2025).

Short-term rentals expanded 65 percent more swiftly than hotel capacity, diverting visitor spending towards residential real estate and limiting housing availability in key areas.

The next figure compares how digital lodging platforms overtook traditional hospitality between 2019 and 2025.

Between 2019 and 2025, all five cities had a threefold rise in rental listings, while hotel growth remained negligible. Wealth is centralised in real estate ownership, converting homes into speculative assets and residents into spectators.

“The same algorithm that made travel accessible also made housing unaffordable.”

-

The Housing Crisis Beneath the Holiday Glow

Tourism revitalised economies while altering daily existence. The Airbnb paradox led to rental costs escalating three to five times more swiftly than wages (UN-Habitat, 2024). In cities from Lisbon to Bali, residents are caught in the conflict between increasing tourism and housing sustainability, a central issue in the tourism boom and housing crisis.

In every city, rental costs have escalated at least thrice relative to wage growth, signifying a shift from tourism as an income stream to a financial encumbrance. The Airbnb paradox has worsened the situation, as twenty percent of core apartments have been transformed into vacation rentals, jeopardising neighbourhoods and escalating prices in adjacent districts. This is a direct consequence of the tourism boom and housing crisis, which has left locals struggling to keep up with rising costs.

This dataset quantifies the difference between rent escalation and income in five major tourist destinations.

In every city, rental costs escalated at a pace at least thrice that of wages, signifying a shift from tourism as an income stream to a financial encumbrance.

Next, we measure the scale of residential conversion into tourist units.

Twenty percent of core apartments have been transformed into vacation rentals, jeopardising neighbourhoods and escalating prices in adjacent districts.

“Every vacation flat is someone else’s missing home.”

-

The Global Ripple — From Platform Capitalism to Policy Panic

The digital rental sector grew more swiftly than regulatory agencies could react. Platforms like Airbnb have globalized the commercialization of local housing, creating rippling effects across fiscal and social systems (IMF, 2025). This reflects the Airbnb Paradox, where the Tourism Boom and Housing Crisis exacerbate affordability issues.

Restrictive and compliance-focused laws curbed inflation and restored transparency, but laissez-faire markets saw rapid progress followed by a decline in affordability. Attaining a balance between sustainable tourism and affordable housing remains a substantial challenge, deepened by the Airbnb Paradox and the ongoing Tourism Boom and Housing Crisis in many cities.

This following figure quantifies regional policy responses and their immediate measurable outcomes.

Restrictive and compliance-focused regulations alleviated inflation and restored transparency; laissez-faire markets had rapid progress followed by a decrease in affordability.

The next dataset quantifies fiscal and housing trade-offs in key cities post-regulation.

Cities enforcing rigorous data controls had a 10–14 percent decrease in rental prices and an 8–20 percent rise in fiscal revenues. Cities experiencing a tourism boom, like Bali, saw rapid expansion despite increasing inequality. The balance of regulation has emerged as the primary worldwide division.

“When cities sell their homes to travellers, they risk becoming museums of themselves.”

-

Reclaiming the City — The Fight for Urban Belonging

Grassroots initiatives have evolved into measurable policy. Global community groups are converting ethical appeals into quantifiable housing reforms (UN-Habitat, 2024).

Cities that empower individuals have reduced illicit listings by an average of 27 percent and enhanced affordability indices by 4 points within a year, indicating that involvement may be more efficacious than enforcement. Quantitative feedback confirms a strong correlation between citizen involvement and urban well-being: average livability rose by 8%, and safety enhanced by 6 points. Sustainable tourism emerges at the grassroots level.

This figure tracks outcomes of the most influential community-driven interventions between 2024 and 2025.

Cities that empower residents have reduced illicit listings by an average of 27 percent and enhanced affordability indices by 4 points within a year, indicating that involvement may be more effective than enforcement.

The next figure evaluates enhancements in livability, affordability, and safety post-reforms, using 2025 metrics.

Sources: UN-Habitat (2024); OECD (2024); World Bank (2025).

Quantitative feedback confirms a positive correlation between citizen engagement and urban well-being: average livability +8 %, safety +6 points. Sustainable tourism begins at street level.

“Cities are not hotels — they’re homes.”

-

Research Insights — Rethinking Tourism, Housing, and Sustainability

Recent studies have linked tourism, digital platforms, and sustainability on a global scale. The Airbnb paradox has shown that it is not just visitor statistics, but also system architecture, that sustains unfairness in housing markets. The tourism boom and housing crisis are closely tied, with digital platforms fueling the displacement of local residents.

- Tourism Elasticity and Urban Pressure – When the rental share surpasses 10%, rents escalate by 30% (OECD, 2024; CBO, 2025). Cities like Lisbon were the first to attain this benchmark, highlighting the impact of the Airbnb paradox. The tourism boom and housing crisis are driving up housing prices in these cities, making it increasingly difficult for locals to afford to live in their own communities.

- Digital Landlordism and Wealth Concentration — 70% of income is designated for multi-property investors (World Bank, 2025). This trend exemplifies the Airbnb paradox, as local values are displaced by global investment. The tourism boom and housing crisis have amplified wealth concentration, with local markets being overtaken by speculative investors.

- AI and Algorithmic Governance — Dynamic pricing intensifies rent inflation; nevertheless, AI can detect illegal listings (IMF, 2025; UN-Habitat, 2024), highlighting the Airbnb paradox in action. The tourism boom and housing crisis continue to evolve, with algorithmic systems exacerbating the affordability issue.

- Environmental Footprint – Tourist accommodations use 30% more water and 20% more electricity (UNEP, 2025), contributing to the broader concerns of the Airbnb paradox. The tourism boom and housing crisis are not only straining local housing markets but also putting additional pressure on urban resources.

- Social Cohesion and Cultural Continuity – Temporary residency erodes trust; community-focused tourism revitalises identity (UN-Habitat, 2024), yet the Airbnb paradox undermines this balance. The tourism boom and housing crisis are eroding local community bonds, as short-term rentals replace long-term residents.

“Research is not resistance—it’s responsibility.”

-

Policy Prospects and The Road Ahead

If research diagnoses the issue, policy defines the cure. The tourism economy must evolve into a circular, accountable system.

- Adaptive Elasticity Caps — Real-time permit controls triggered by housing affordability (CBO, 2025). Paris and Amsterdam are testing this successfully.

- Dynamic Tourist Taxes — Sliding levies adjust by season and impact; Venice’s 2025 entry tax funds resident services (OECD, 2024).

- AI-Enabled Transparency — Mandatory open APIs and blockchain registries for all platforms (UN-Habitat, 2024).

- Housing Re-conversion Grants — Lisbon’s model restores homes; scalable via World Bank funding (2025).

- Global UN Tourism Compact — UNWTO and UNEP pursue data standards and funded compliance (2025).

- Aligning with SDGs — Integrate SDG 11 (Sustainable Cities) & SDG 8 (Decent Work) into tourism plans.

- Re-imagining Travel Culture — Encourage longer stays and off-season visits; ethical tourism as brand value.

“True prosperity means visitors can come — and residents can still afford to return home.”

-

Final Word — The Cost of Wanderlust

Every age has its wanderlust, but today’s digital mobility has a cost. Behind every “stay” is a displaced neighbor. The next chapter of tourism must balance movement with memory, prosperity with place.

“The future of travel depends not on how many arrive, but on how many can still afford to live where they belong.”