High interest rates now dominate the global economy as persistent and sticky inflation refuse to fall. This blog examines how prolonged monetary tightening, price stickiness, and rising debt burdens are reshaping global fiscal stability. Explore why elevated borrowing costs are becoming structural and how they will define economic outcomes in 2025 and beyond.

INTRODUCTION

The global economy has entered a defining moment shaped by high interest rates, persistent inflation, and stubborn price stickiness that refuses to ease. As inflation lingers despite aggressive tightening cycles, households, firms, and governments face rising financial strain. These dynamics raise deeper concerns about debt, inflation, global fiscal stability, and the long-term sustainability of current monetary paths. Central banks warn that price pressures remain entrenched, while governments struggle to manage debt servicing and widening fiscal deficits. Additionally, elevated borrowing costs have slowed investment, weakened consumption, and introduced new vulnerabilities in global credit markets.

In this environment of prolonged monetary rigidity, the world is confronting a new macroeconomic reality—one where inflation remains sticky, growth remains fragile, and interest rates remain high.

The following analysis explores how this high-rate shockwave is transforming economies, reshaping policy, and redefining global financial resilience.

1. The Monetary Tightening Cycle & High Interest Rates

The rise of high interest rates marks a fundamental shift in global monetary policy. After nearly a decade of ultra-low and even negative rates, central banks have reversed course in response to persistent inflation across advanced and emerging markets. This tightening cycle is driven by price stickiness in energy, housing, services, and food, all of which have been slow to normalize post-pandemic. Moreover, central banks increasingly fear that lowering rates prematurely could trigger renewed inflationary spikes.

Consequently, monetary authorities across the U.S., Europe, and Asia are signaling a longer period of restrictive policy. This shift affects not only household borrowing costs but also business investment, capital flows, and sovereign debt sustainability. The new era of high interest rates is reshaping global economic norms at every level.

The IMF’s 2025 Monetary Outlook notes: “High interest rates are now part of a structural, not cyclical, adjustment as inflation persistence remains a global challenge.” Meanwhile, the BIS warns that prolonged tightening has pushed global debt-servicing costs to their highest level since 2008. The OECD adds that in many advanced economies, real policy rates remain positive for the first time in decades, reinforcing restrictive conditions.

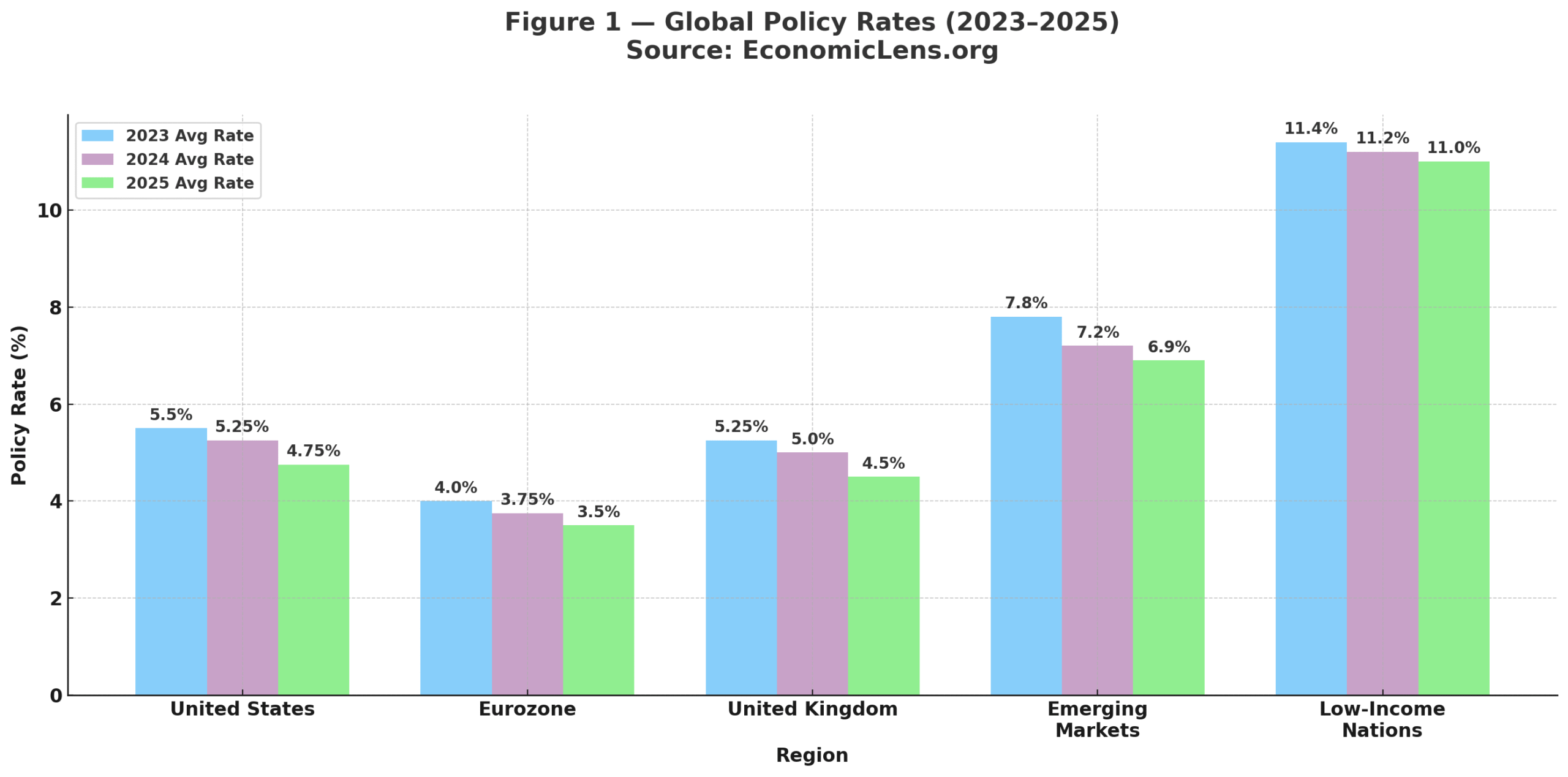

Despite slight declines in some regions, interest rates remain far above pre-pandemic norms. Europe and the U.S. maintain restrictive stances, while emerging markets face extremely high real rates due to currency and inflation pressures. Low-income economies bear the heaviest burden, as high rates compound financial instability.

“When money becomes expensive, every economic decision—from buying a home to running a business—carries heavier weight and higher risk. The world is learning this lesson all over again.”

2. Persistent Inflation & Global Price Stickiness

Despite aggressive tightening, persistent inflation remains a defining global challenge. Key sectors such as housing, health care, transportation, and food continue to exhibit sticky inflation, driven by structural shortages, supply-chain resets, wage adjustments, and geopolitical tensions. Prices may no longer be rising rapidly, but they are not falling either—leaving consumers with a new, permanently higher cost of living.

This stickiness is compounded by global commodity volatility and supply fragmentation. As a result, inflation expectations remain elevated, making central banks reluctant to ease rates.

Persistent inflation is no longer a temporary shock—it’s a structural reconfiguration of global price levels.

According to the World Bank, “Two-thirds of global inflation components are now driven by structural factors rather than cyclical shocks.” The OECD highlights that services inflation remains double pre-pandemic averages in most advanced economies. Meanwhile, the ECB notes that wage growth above 4% annually has reinforced long-term price stickiness across Europe.

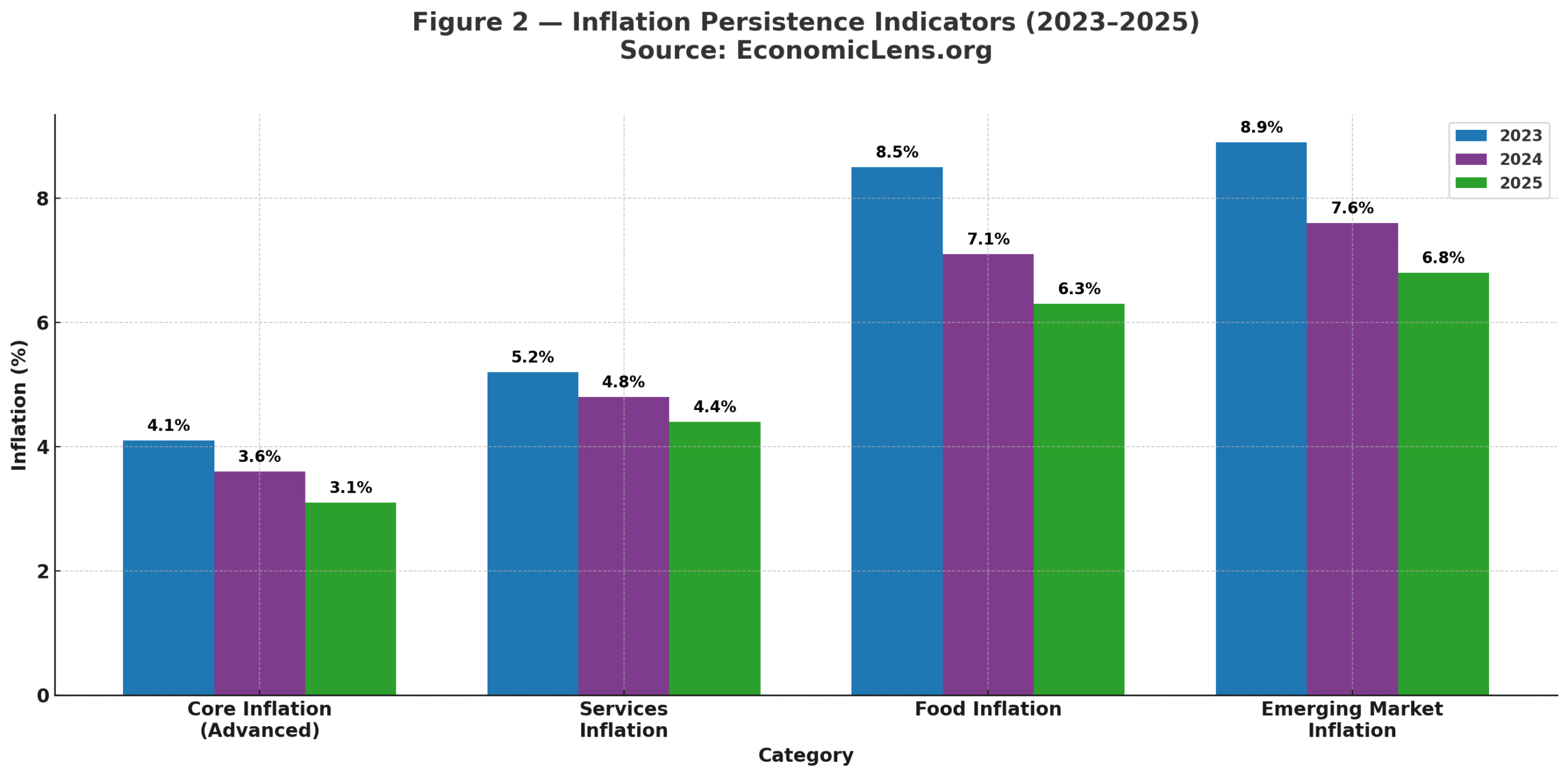

Though inflation is decreasing gradually, it remains above policy targets across most categories. Services inflation is the most stubborn, reflecting wage pressures and cost pass-through dynamics. Emerging markets face elevated food inflation, worsening inequality and social risk.

“The inflation battle isn’t won when prices slow—it’s won when they fall. And so far, they haven’t.”

3. Fiscal Stress, Debt Burdens & the High-Rate Shockwave

The combination of high interest rates and persistent inflation is straining fiscal systems worldwide. Governments face rising borrowing costs, higher debt-servicing obligations, and widening deficits. Meanwhile, revenue bases are weakening as growth slows. These pressures are particularly severe in emerging and low-income economies, where debt vulnerabilities are already elevated.

Moreover, sovereign refinancing cycles in 2025–2027 coincide with historically tight global financial conditions. Consequently, even countries with previously stable debt profiles now face heightened refinancing risk. This high-rate shockwave is transforming fiscal sustainability into a global priority.

The IMF warns that “40% of emerging markets and 60% of low-income countries now face moderate to high risk of debt distress.” The BIS notes that global interest payments surpassed $3 trillion annually for the first time in 2024. The World Bank adds that elevated borrowing costs threaten long-term growth as governments divert spending from development to debt service.

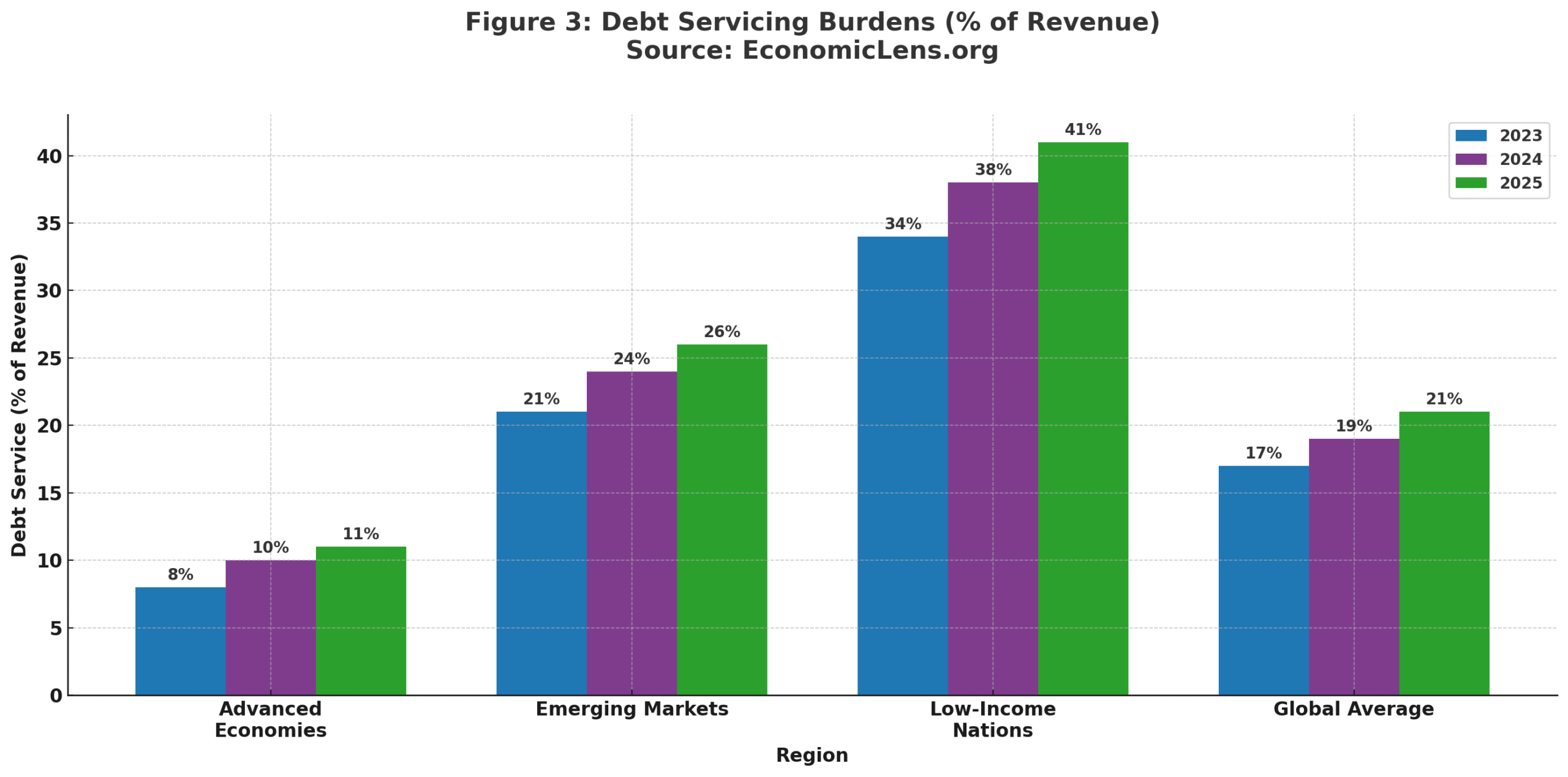

Debt servicing is rising across all income groups, but the burden is disproportionately severe in low-income nations, where limited fiscal space intensifies vulnerability. Emerging markets face looming rollover risks, while advanced economies must contend with slower growth and rising fiscal pressures.

“When interest costs rise faster than revenue, debt becomes a trap—and escaping it becomes nearly impossible.”

4. Households, Firms & the Cost-of-Living Squeeze

Sticky inflation and high interest rates have reshaped financial behavior across households and firms. Higher mortgage rates, credit-card interest, and business loan costs have reduced disposable income and slowed consumption. Similarly, small firms face elevated financing barriers, making it harder to invest, hire, or expand operations.

Moreover, households are increasingly prioritizing debt repayment over consumption, slowing economic activity. In many countries, consumer sentiment remains historically low despite improving headline inflation. This structural squeeze signals long-term challenges for growth and financial resilience.

OECD research shows that household debt-service ratios rose by an average of 2 percentage points across advanced economies between 2022 and 2025. Meanwhile, the Federal Reserve notes that delinquency rates on credit cards and auto loans have reached their highest levels in over a decade. Moody’s reports that small business bankruptcies increased by 18% worldwide in 2024 due to tighter credit conditions.

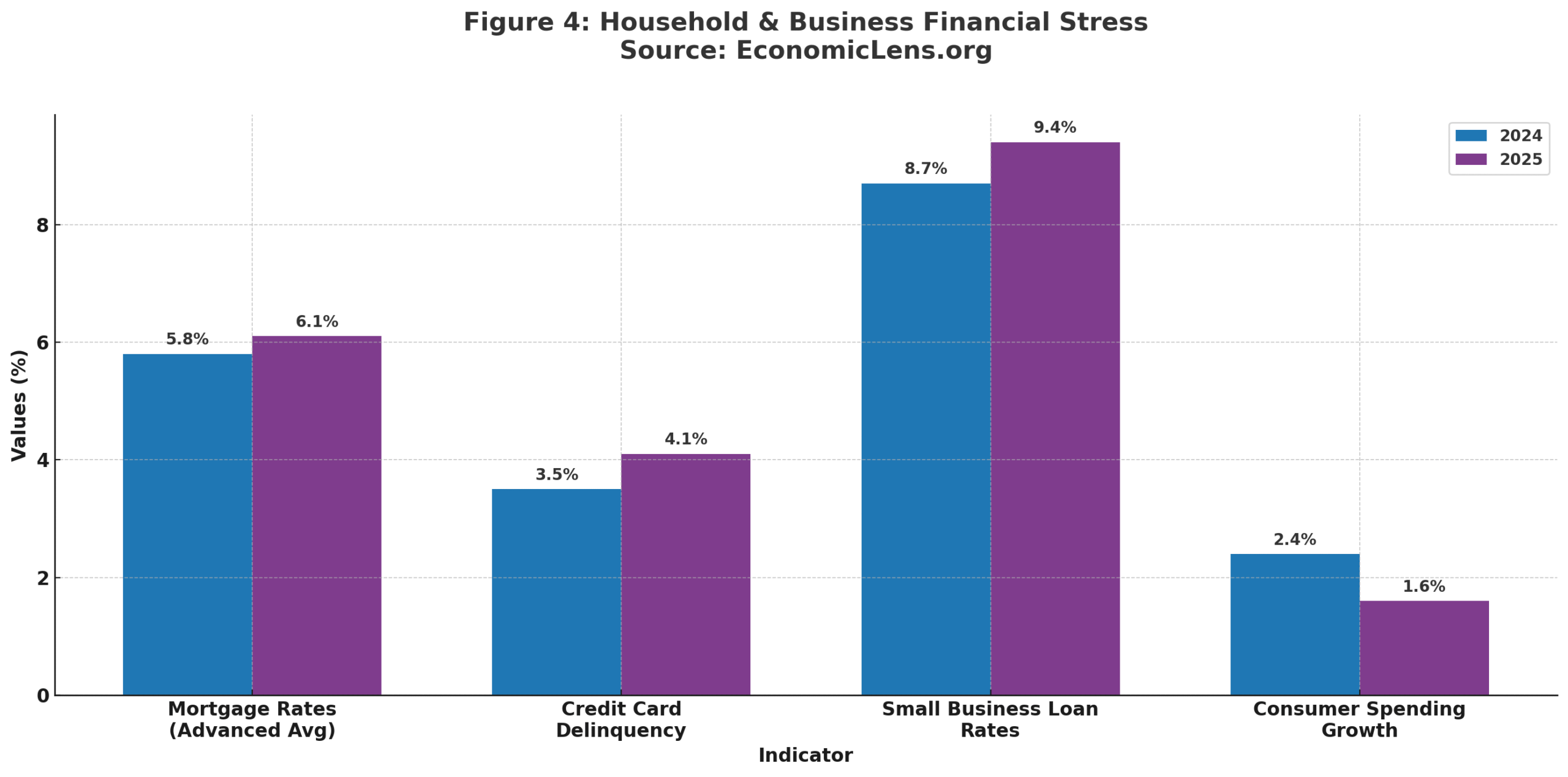

Credit has become significantly more expensive, and consumers are responding by reducing discretionary spending. Business financing has tightened, limiting growth and investment. These shifts signal long-term demand softness in the global economy.

“When borrowing becomes a burden, spending becomes a sacrifice—and growth becomes a casualty.”

5. Global Investment Slowdown & Falling Growth Potential

High interest rates and persistent inflation have dampened global investment. Capital-intensive sectors such as manufacturing, technology, infrastructure, and real estate face high financing costs and uncertain returns. Additionally, risk premiums have risen, reducing investor appetite for emerging markets.

Consequently, both private and public-sector investment growth has slowed, threatening long-term productivity and innovation. As investment weakens, global growth potential diminishes, increasing vulnerability to future shocks.

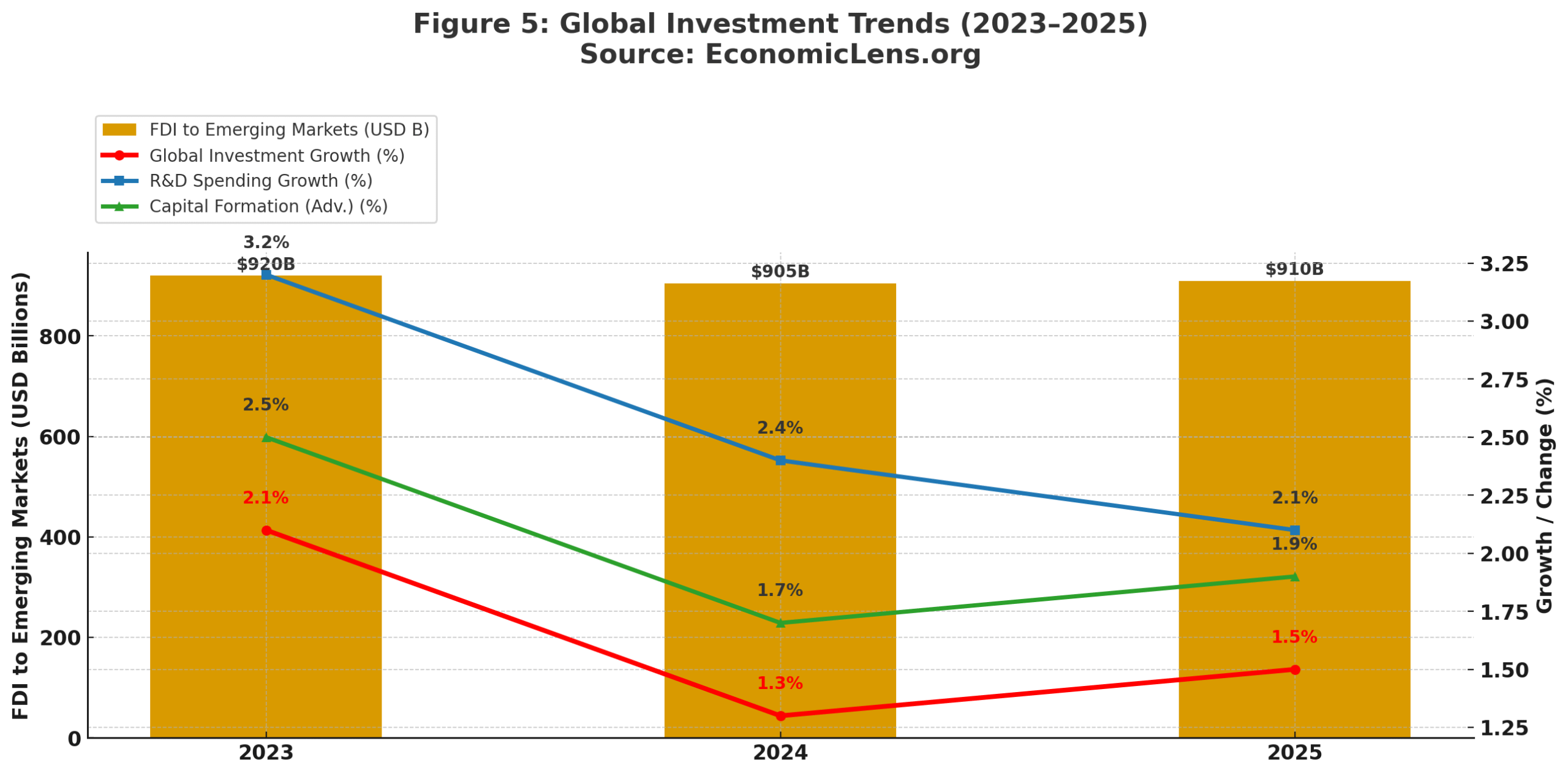

The World Bank reports that global investment growth fell to just 1.3% in 2024—the lowest level since 2001 excluding crises. The IMF warns that if high rates persist, potential global GDP growth could fall by 0.4 percentage points annually through 2030. UNCTAD notes that foreign direct investment inflows to emerging markets have

Investment erosion poses long-term structural risks, constraining growth, technological progress, and productivity gains. Without substantial investment recovery, economies may face prolonged periods of lower potential growth.

“When economies stop investing in the future, the future stops investing in them.”

POLICY IMPLICATIONS

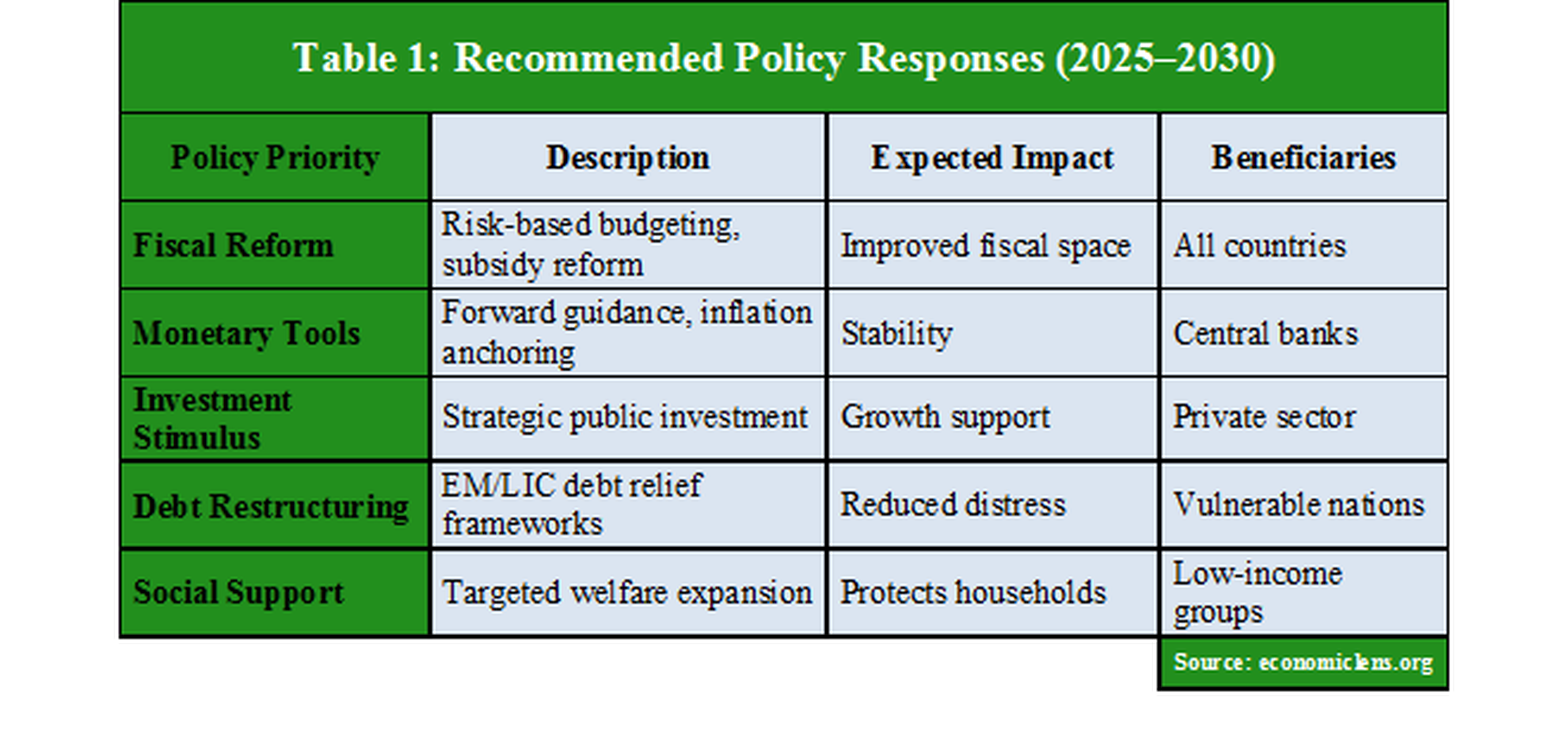

The persistence of high interest rates and ongoing inflation demands a fundamental shift in policy strategy. Governments must navigate rising debt-servicing burdens, weakening growth, and narrowing fiscal space. Moreover, policymakers must consider how structural price stickiness shapes long-term monetary frameworks. Emerging markets require enhanced support to manage refinancing risks, while advanced economies must recalibrate fiscal rules for a high-rate world.

This new macroeconomic reality requires policies that strengthen resilience, promote investment, and protect vulnerable populations.

The IMF recommends revising fiscal frameworks to incorporate interest-rate risk and inflation persistence explicitly. The OECD calls for targeted social support to offset the cost-of-living squeeze. The BIS emphasizes the need for macroprudential tools to prevent financial instability caused by high borrowing costs.

A coordinated approach is essential. Fiscal reforms strengthen long-term stability, while investment stimulus supports growth. Debt restructuring will be crucial for emerging and low-income nations facing severe debt-servicing pressures. Social safety nets must expand to protect the most vulnerable.

“Policies written for yesterday’s economy will fail tomorrow’s world. Governments must adapt—or fall behind.”

FUTURE OUTLOOK

Going forward, high interest rates may remain elevated longer than expected, especially if sticky inflation continues to pressure central banks. Debt burdens will rise, and global fiscal stability may weaken as refinancing cycles approach. Although inflation may ease gradually, structural price stickiness will keep policy tight. The world is entering a prolonged period of slow growth, elevated risk, and constrained policy flexibility.

CONCLUSION

The global economy stands at a crossroads shaped by high interest rates, persistent inflation, and sticky price dynamics. These forces are reshaping borrowing behavior, slowing investment, and placing severe pressure on fiscal stability. Moreover, their combined impact threatens to amplify debt, inflation, and global fiscal stability vulnerabilities across economies. This high-rate shockwave is more than a temporary cycle—it is a structural shift with long-term consequences.

As the world adjusts to this new era, policymakers, businesses, and households must recognize that stability will depend on adaptation, resilience, and strategic planning.

CALL TO ACTION

The high-rate era demands vigilance and proactive strategy. Policymakers must build fiscal buffers, strengthen social protections, and prepare for persistent volatility. Businesses and individuals should manage debt carefully and plan for elevated borrowing costs.