US Tariff Shock 2025 intensifies global economic stress as new tariffs disrupt trade flows, raise consumer prices and trigger supply chain realignments. This blog explains how these tariffs reshape global markets, elevate inflation risks, weaken manufacturing and expose emerging economies to serious financial pressure.

INTRODUCTION

The US Tariff Shock 2025 marks one of the most consequential trade interventions in modern economic history, reshaping global trade flows, consumer prices and supply chain networks. In the US Tariff Shock 2025 environment, new duties on Chinese goods, steel, autos, electronics and key manufacturing inputs have triggered immediate volatility across global markets. Additionally, importers and exporters now face higher costs, reduced competitiveness and increased uncertainty.

Furthermore, supply chains are being reconfigured as Chinese, Asian, European and Latin American producers react to new barriers. Meanwhile, American consumers face higher prices because tariff costs pass directly into inflation. Consequently, the global economy experiences renewed stress that extends far beyond bilateral US-China tensions.

This blog explains how US Tariff Shock 2025 affects trade flows, global inflation, supply chains, emerging markets and long-term economic resilience using data-driven analysis and global report insights.

For a broader understanding of how global trade blocs are reshaping economic power, see our analysis on the Future of International Trade

https://economiclens.org/the-future-of-international-trade-how-economic-blocs-are-reshaping-the-global-economy/

1. US Tariff Shock 2025 and Global Trade Disruption

The US Tariff Shock 2025 introduces sweeping duties on a wide range of imported goods, including electronics, automobiles, steel, machinery and consumer items. As a result, global trade flows have shifted abruptly. Additionally, supply chains optimized over decades of integration are now being disrupted in real time. According to Al Jazeera, several categories of imports have already declined sharply as firms struggle with compliance costs and price spikes.

Furthermore, the US trade deficit temporarily narrowed due to import suppression, but global export volumes weakened as foreign suppliers adjusted. Consequently, global trade elasticity declines as uncertainty increases.

Expert Insight & Global Report Signals

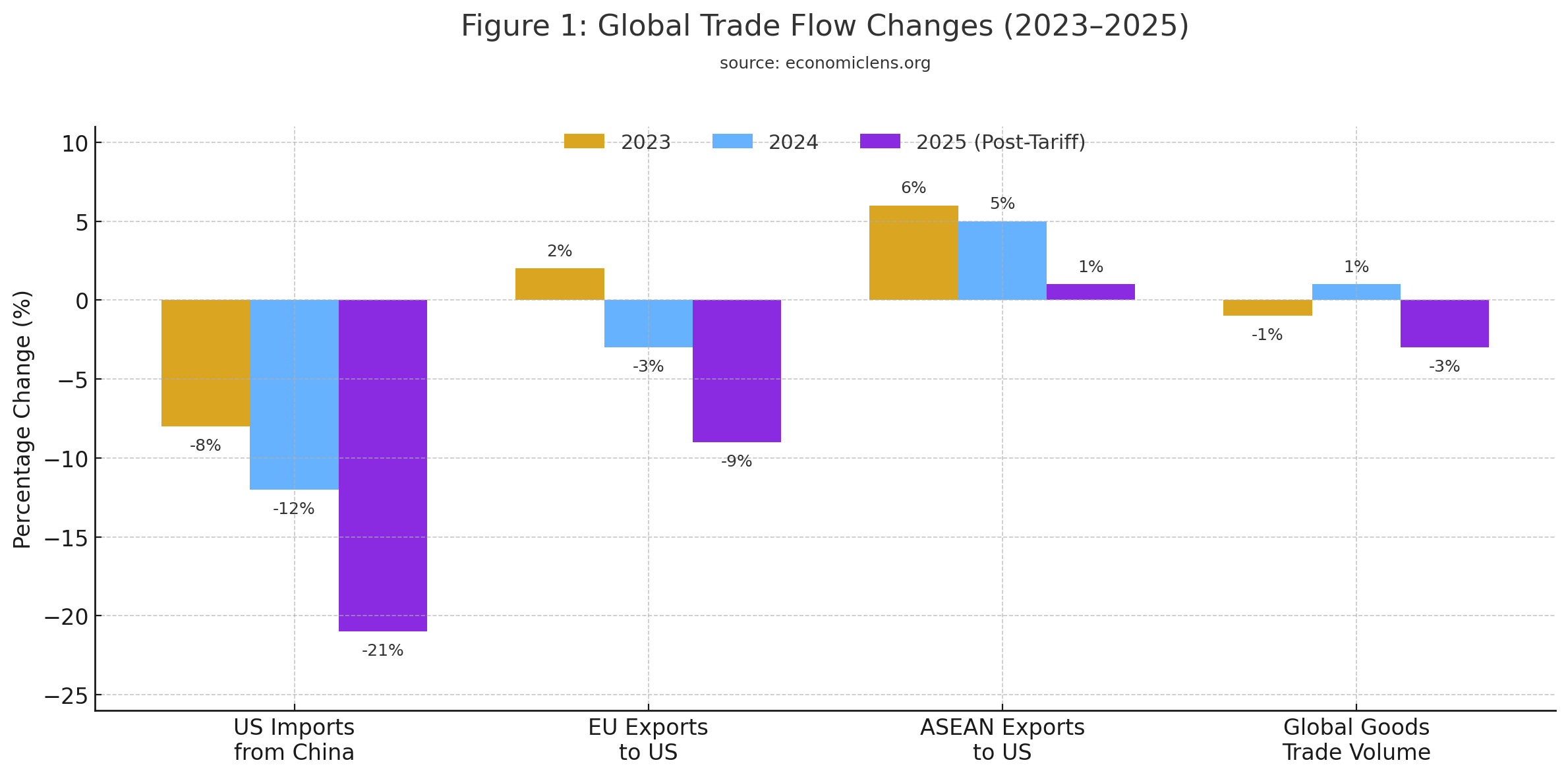

The WTO World Trade Outlook 2025 (https://www.wto.org) notes that global goods trade volumes contracted by nearly 3 percent in the first quarter of 2025 due to tariff-related disruptions. Additionally, the IMF External Sector Report 2025 (https://www.imf.org/en/publications) highlights rising global current account imbalances linked to tariff shocks.

For deeper macroeconomic context, see our related analysis “Global Economic Outlook 2025–2026: Slow Growth, Sticky Inflation and Rising Debt” (https://economiclens.org/global-economic-outlook-2025-2026-slow-growth-sticky-inflation-rising-debt/)

Trade flows between the US and China have declined significantly, forcing producers to reroute shipments through alternative hubs. Moreover, Asian supply chain economies, including Vietnam, Thailand and Malaysia, are experiencing increased orders but also higher compliance burdens.

European exporters face reduced demand in automotive and machinery. Consequently, trade losses extend beyond direct US-China channels.

Trade flows show widespread contraction following the US Tariff Shock 2025 as import demand weakens and exporters face higher compliance costs. Consequently, global supply chains experience significant disruption, reducing competitiveness and increasing volatility.

Asian Export Losses as a Mirror of Global Trade Disruption

Asian electronics, machinery and textile exporters see a sharp drop in US orders after the US Tariff Shock 2025. Regional trade ministries report that shipments to the US fall by more than 15 percent in early 2025 as tariffs raise prices and weaken competitiveness. Firms also face costly supply chain rerouting and higher input expenses. As a result, manufacturing hubs in Vietnam, Malaysia and South Korea confront layoffs, reduced production and weaker investment inflows. The region shows a clear mirror of how global trade disruption spreads across interconnected supply chains.

“Trade shocks ripple through every economy because global supply chains bind nations together.”

2. Inflation Surge and Tariff Driven Inflation Stress

The US Tariff Shock 2025 acts as an indirect tax on imported goods, raising costs for businesses and consumers. Price increases in electronics, household goods, autos and machinery directly feed into inflation. Consequently, household budgets remain under pressure as tariffs compound existing cost-of-living challenges.

Since tariffs apply to inputs used by US manufacturers, production costs rise across multiple industries, worsening price stress.

Expert Insight & Global Report Signals

The US Bureau of Labor Statistics Inflation Analysis 2025 (https://www.bls.gov) reports clear evidence of tariff pass-through into retail prices. Meanwhile, the Tax Foundation Tariff Impact Study (https://taxfoundation.org) shows that the average American household faces an additional USD 1,700 per year due to tariff-driven inflation.

For insights on market behaviour during inflation surge, see “AI Stock Market Bubble 2025: Big Tech Concentration and Global Market Risk” (https://economiclens.org/ai-stock-market-bubble-2025-big-tech-concentration-global-market-risk/)

Import price inflation accelerated to nearly 15 percent in 2025 following the tariff hike. Producer prices increased due to rising costs of steel, electronics components, machinery and consumer goods. Consequently, US inflation remains higher than comparable advanced economies.

Tariffs significantly increase import and producer prices, pushing overall inflation higher. As a result, households experience rising cost-of-living pressure while domestic firms face margin compression and reduced competitiveness.

US Middle Income Families Face Price Squeeze Reflecting Tariff Driven Inflation

American middle income households face rising costs for electronics, clothing, home goods and appliances as tariff driven inflation spreads across retail markets. Consumer surveys show that tariff pass through increases the price of common items by 12 to 20 percent. At the same time, wage growth remains soft, forcing families to cut discretionary spending. As a result, real purchasing power weakens and consumption slows. The trend offers a clear lesson on how tariff driven inflation hits middle class budgets first and hardest.

“When trade barriers rise, inflation follows quickly and households absorb the shock.”

3. Supply Chain Realignment and Manufacturing Downturn After US Tariff Shock 2025

US Tariff Shock 2025 disrupts global supply chains by raising costs for intermediate goods and inputs. Manufacturers dependent on imported components face higher production expenses, delayed shipments and reduced competitiveness. Additionally, supply rerouting through alternative markets increases logistical complexity.

Consequently, supply chain resilience becomes a strategic priority for firms and governments. For deeper insight into shifting global power structures, explore our detailed analysis of BRICS expansion and de dollarization trends

https://economiclens.org/brics-expansion-de-dollarization-and-the-shift-in-global-finance/

Expert Insight & Global Report Signals

The OECD Global Value Chain Report 2025 (https://www.oecd.org) identifies tariffs as a major driver of supply chain restructuring. Additionally, the UNCTAD Supply Chain Monitoring Report 2025 (https://unctad.org) notes increased lead times and rising freight costs following tariff implementation.

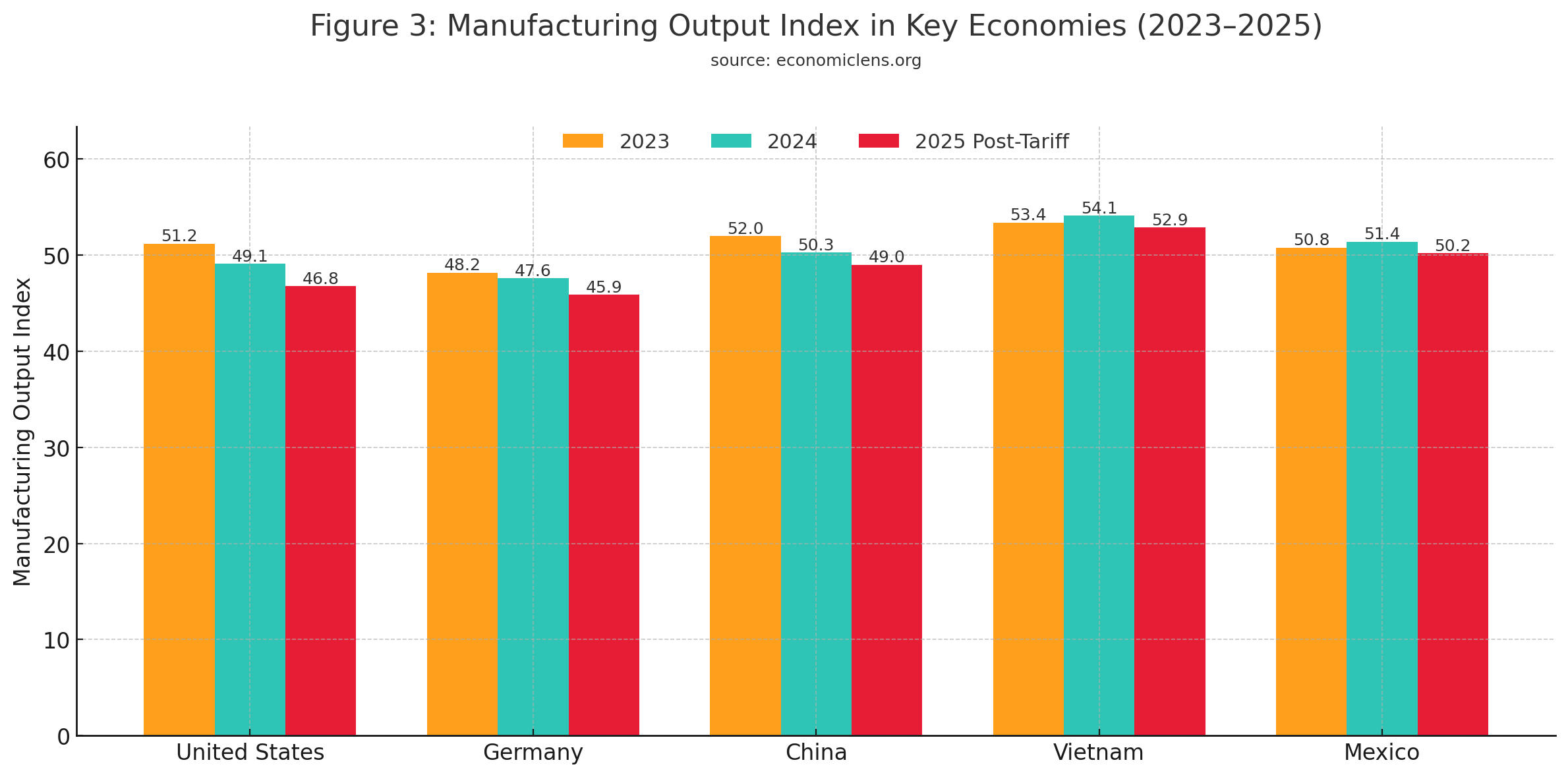

Manufacturing-sector output has contracted in Europe, Japan and several emerging markets. Meanwhile, supply-chain economies such as Vietnam and Mexico experience increased orders, yet also face higher compliance and transportation burdens.

Manufacturing output weakens across major economies due to tariff-driven disruptions and elevated input prices. Consequently, supply chain efficiency declines and firms shift sourcing strategies toward diversified or near-shored hubs.

European Automakers Confront Input Shortages Showing the Cost of US Trade War Costs

European car manufacturers face rising production costs as tariffs increase the price of steel, machinery and electronic components. Industry data shows that plants in Germany and France experience part shortages and higher import expenses throughout 2025. As a result, automakers cut output, delay orders and raise prices. The case offers a clear lesson on how US trade war costs disrupt advanced manufacturing systems that depend on stable global supply chains.

“A single trade shock can unravel decades of finely tuned supply chain efficiency.”

4. Emerging Markets Under Global Trade Disruption Pressure

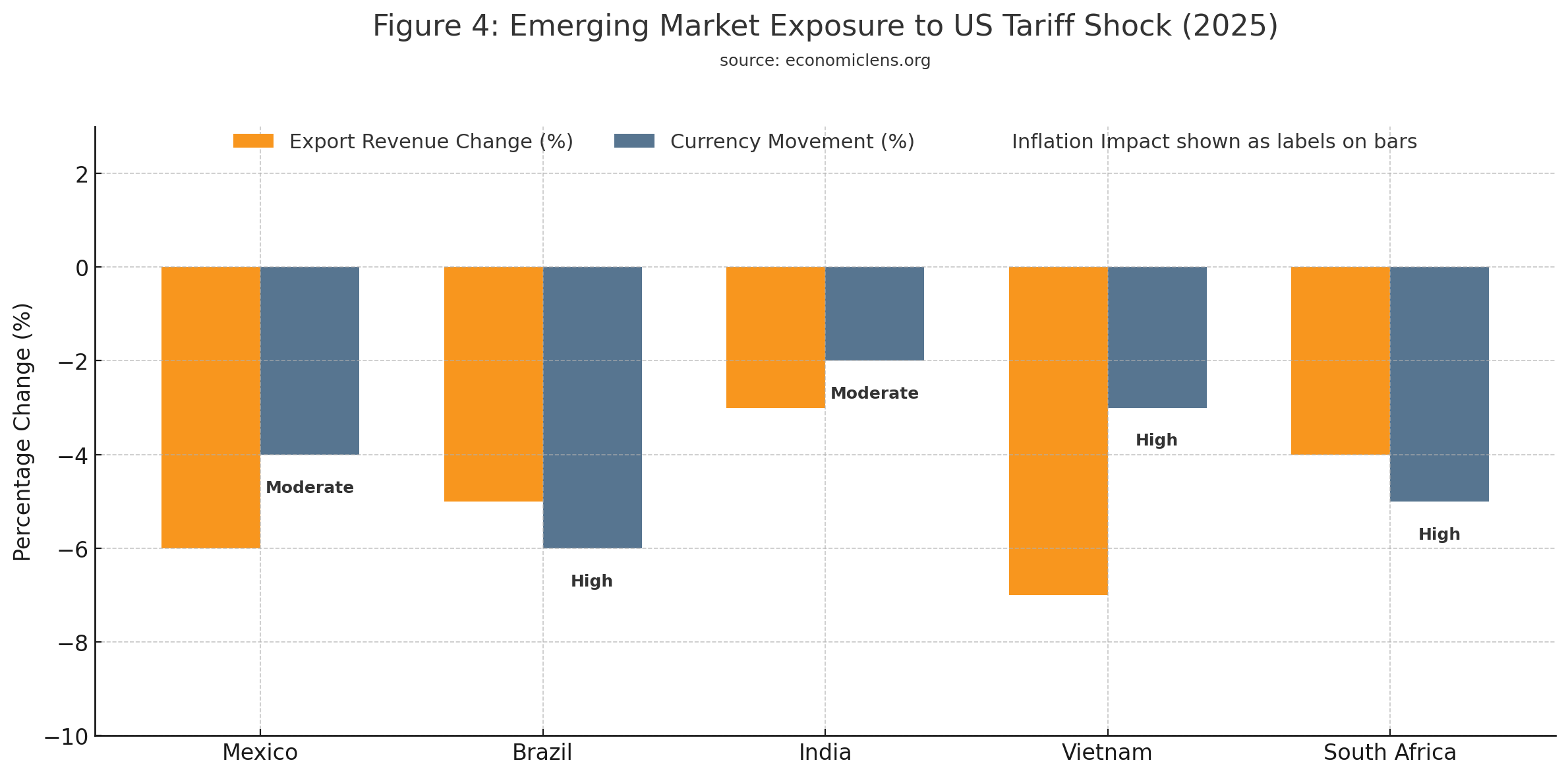

Emerging markets reliant on exports to the United States experience substantial economic pressure following the US Tariff Shock 2025. Although some benefit from diverted supply chains, most face reduced export revenues, currency depreciation, inflationary pressures and weaker external positions.

Consequently, financial vulnerabilities grow across developing economies.

Expert Insight & Global Report Signals

The World Bank Global Economic Prospects 2025 (https://worldbank.org) warns that US tariffs sharply reduce export incomes for developing economies. Additionally, the Asian Development Bank Trade Brief 2025 (https://adb.org) highlights falling demand for key emerging market exports.

Exporters in Latin America, Africa and South Asia experience reduced demand for agricultural, textile and electronics products. Meanwhile, currency depreciation increases import costs, widening inflation pressure.

Emerging markets experience reduced export income and currency depreciation due to lower US demand. Consequently, inflation increases and external vulnerabilities worsen, placing additional stress on already fragile economies.

Latin American Exporters Face Currency and Revenue Declines Under the US Tariff Shock 2025

Latin American agricultural and manufacturing exporters face weaker US demand as tariff driven price increases reduce competitiveness. Regional banks report that export revenues fall by nearly USD 12 billion in early 2025. At the same time, currency depreciation raises the cost of imported fertiliser, machinery and energy. As a result, the region provides a clear lesson on how the US Tariff Shock 2025 creates both income losses and inflation pressure in vulnerable economies.

“A tariff in one nation becomes an economic storm for many others.”

5. Policy Response, Supply Chain Realignment and US Tariff Shock 2025 Outlook

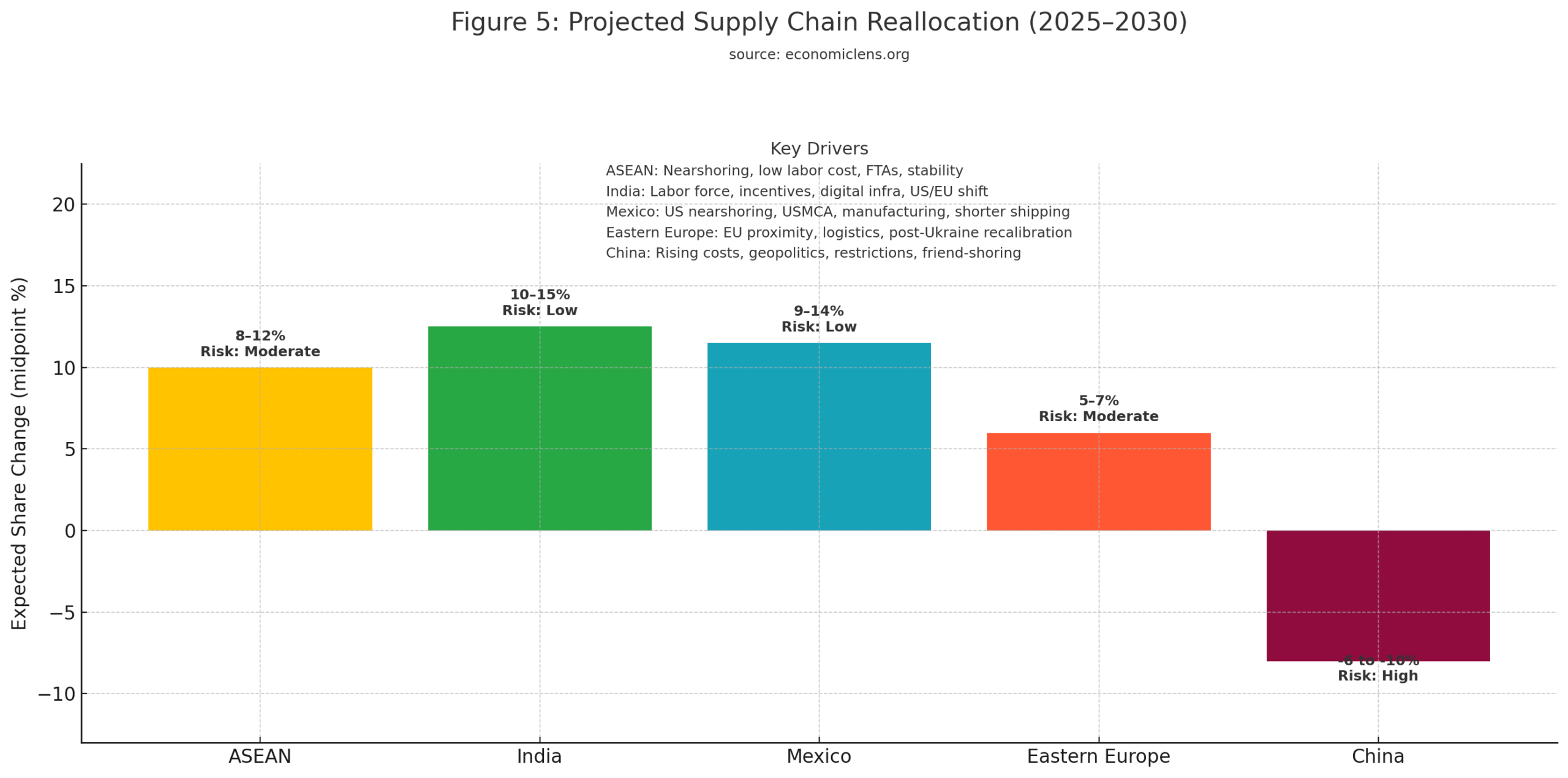

Governments worldwide now reconsider supply chain strategies, trade agreements and industrial policies in response to the US Tariff Shock 2025. As a result, near-shoring, friend-shoring and diversification accelerate. Furthermore, global trade governance enters a period of renewed uncertainty as nations react to rising protectionism.

Expert Insight & Global Report Signals

The OECD Trade Policy Review 2025 (https://oecd.org) emphasizes the growing shift toward regional supply chains. Additionally, the WTO Global Trade Policy Monitor (https://wto.org) highlights an increase in protectionist measures worldwide following the US tariff actions.

While some economies benefit from supply chain realignment, many face prolonged uncertainty. Manufacturing transitions to ASEAN, India, Mexico and Eastern Europe accelerate. Meanwhile, technology-intensive industries experience the fastest restructuring.

Supply chain reallocation accelerates toward ASEAN, India and Mexico as firms diversify away from tariff exposure. Consequently, global production networks undergo structural transformation, reshaping competitiveness and long-term economic geography.

ASEAN and India Gain as Firms Exit China Through Supply Chain Realignment Lessons

Tariff pressure increases the speed of supply chain diversification toward ASEAN and India. Industry surveys report that new investments in electronics, automotive parts and textiles rise by more than 22 percent in 2025. As a result, the region shows how supply chain realignment creates new winners when global trade disruption reshapes production networks.

“Trade realignment defines the next decade as firms rebuild resilience through diversification.”

Conclusion

The US Tariff Shock 2025 triggers widespread economic disruptions that extend far beyond US-China trade tensions. Rising import prices fuel higher inflation, squeezing household budgets and reducing consumption. Meanwhile, supply chains fragment, manufacturing activity declines and exporters confront weakening demand.

Emerging markets experience income losses, currency depreciation and inflationary shocks that intensify financial vulnerabilities. Additionally, global trade governance becomes increasingly unstable as protectionist measures multiply.

However, supply chain diversification presents opportunities for ASEAN, India, Mexico and other emerging hubs. Although uncertainty persists, strategic realignment may enhance resilience if supported by smart policy frameworks, investment in logistics and coordinated trade reforms.

Ultimately, navigating the US Tariff Shock 2025 requires adaptive strategies, balanced protection, and cooperative global policy engagement to safeguard economic stability.

For related insights on how countries are redesigning trade routes and industrial capacity, read our work on Supply Chain Sovereignty and global trade realignment

https://economiclens.org/supply-chain-sovereignty-the-new-realignment-in-global-trade/

Call to Action

Policymakers and firms must respond quickly to rising protectionism by strengthening supply chain resilience, improving competitiveness and enhancing global trade coordination. As industries restructure, strategic investments and long-term planning remain essential.

“Economic resilience emerges when nations adapt to shocks, diversify risks and embrace forward-looking trade strategies.”