- EconomicLens Homepage

- /

- Visual Stories

Structural youth unemployment examines why youth joblessness is becoming entrenched across emerging and developing economies. Skills mismatch, AI disruption, weak labor demand, and rising NEET populations are driving long term

Global debt risks 2026 explain why total debt above 330 percent of global GDP is elevating financial stress across sovereign, corporate, and household sectors. Rising interest costs, slowing credit, and

AI job disruption 2026 highlights how artificial intelligence is reshaping employment patterns. While technology, finance, and healthcare accelerate AI adoption, roles in customer service, office support, and media face rising

Global economic slowdown 2026 explains why economic conditions feel constrained even as inflation falls. Tight monetary policy, weak investment, trade disruptions, and rising debt burdens are slowing global growth momentum.

Currency devaluation episodes show how exchange rate depreciation spreads across emerging markets. External debt burdens rise, inflation accelerates, reserves fall, and capital outflows increase. This visual story explains the cause,

The PIA privatization reform deal marks a turning point in Pakistan’s handling of loss making state owned enterprises. Years of mounting deficits made incremental fixes ineffective, as explained in EconomicLens’

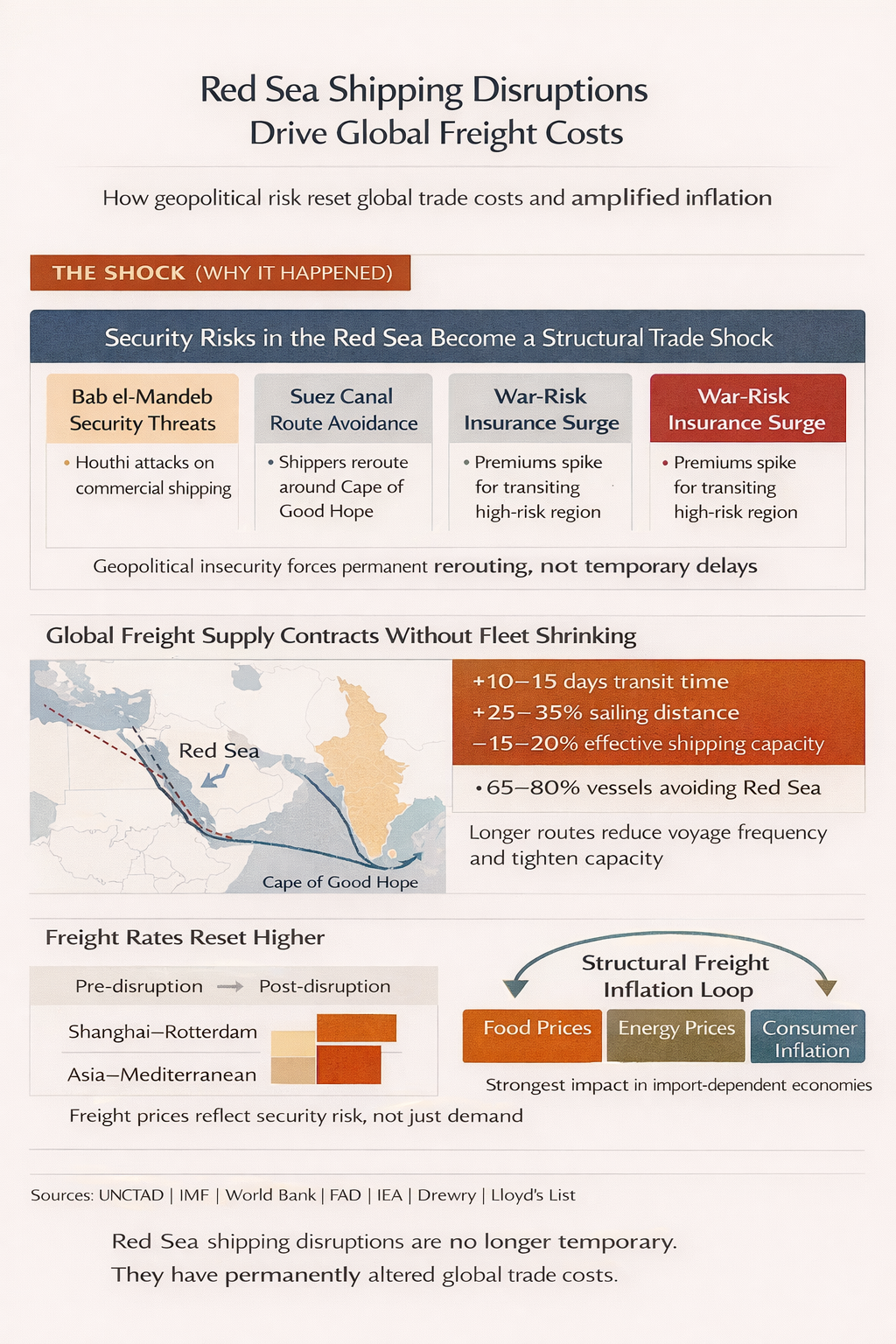

Red Sea shipping disruptions are reshaping global trade as security risks force rerouting, reduce effective shipping capacity, and reset freight costs higher, amplifying food, energy, and consumer inflation across import-dependent

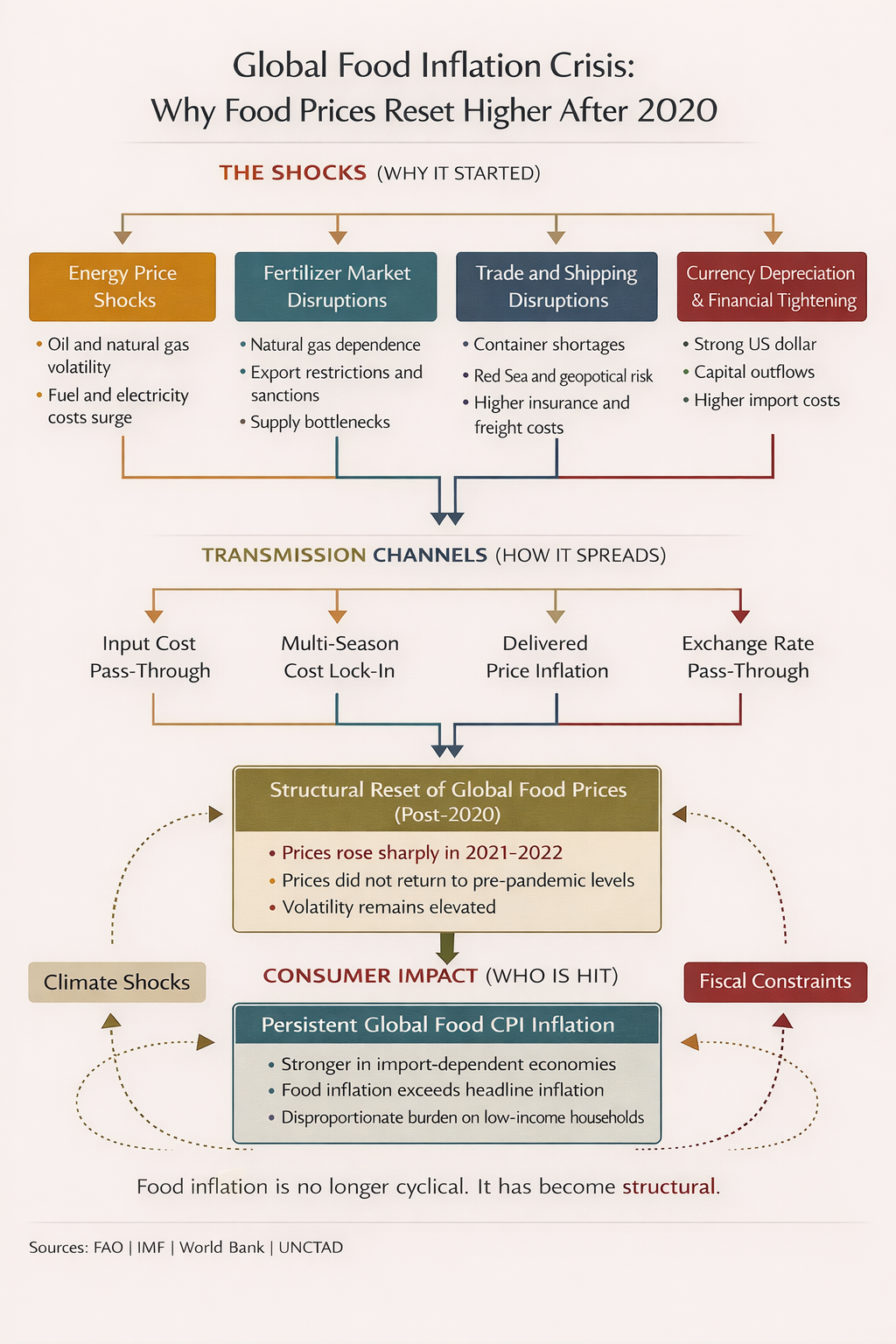

The global food inflation crisis reflects a structural reset in food prices after 2020. Energy shocks, fertilizer disruptions, trade costs, currency depreciation, and climate stress pushed prices sharply higher in