State fragility and economic spillovers are increasingly shaping economic outcomes across emerging and conflict-exposed economies. Rather than remaining isolated political crises, current fragility is both multidimensional and persistent. In particular, governance breakdown, social stress, and security disruption are unfolding simultaneously. As a consequence, economic damage now extends beyond short-term shocks and penetrates labor markets, fiscal capacity, and long-run growth potential. Moreover, state fragility and economic spillovers are no longer confined to national boundaries. Instead, they increasingly generate regional instability and cross-border macroeconomic transmission. In this context, fragile states act as amplifiers rather than absorbers of economic shocks.

Executive Snapshot: Fragile States and Economic Spillovers

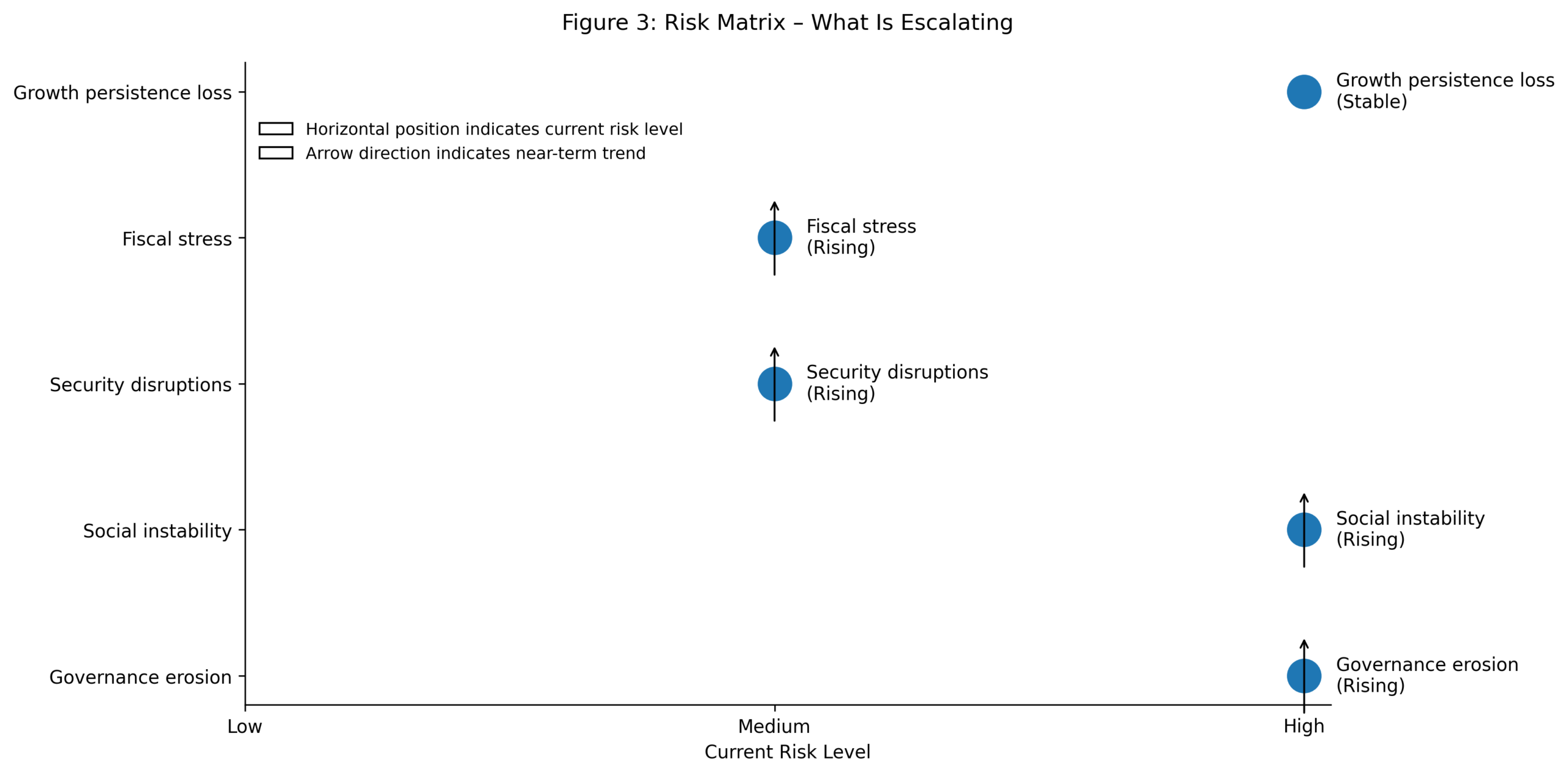

State fragility and economic spillovers have gradually shifted from episodic disturbances into structural macroeconomic constraints. At the same time, governance capacity is weakening across multiple fragile settings. Meanwhile, social systems face mounting demographic pressure alongside rising youth vulnerability. In addition, ongoing security disruptions continue to fragment trade networks and restrict labor mobility. Consequently, fragile economies experience weaker growth persistence, higher inflation volatility, and chronic fiscal stress. Beyond domestic effects, spillovers increasingly affect neighboring economies through migration flows, trade disruption, and financial exposure. Taken together, these dynamics reinforce fragility and deepen regional economic interdependence.

Key numbers this week: Institutional Fragility and Regional Spillovers

- Fragile economies account for 67% of global extreme poverty

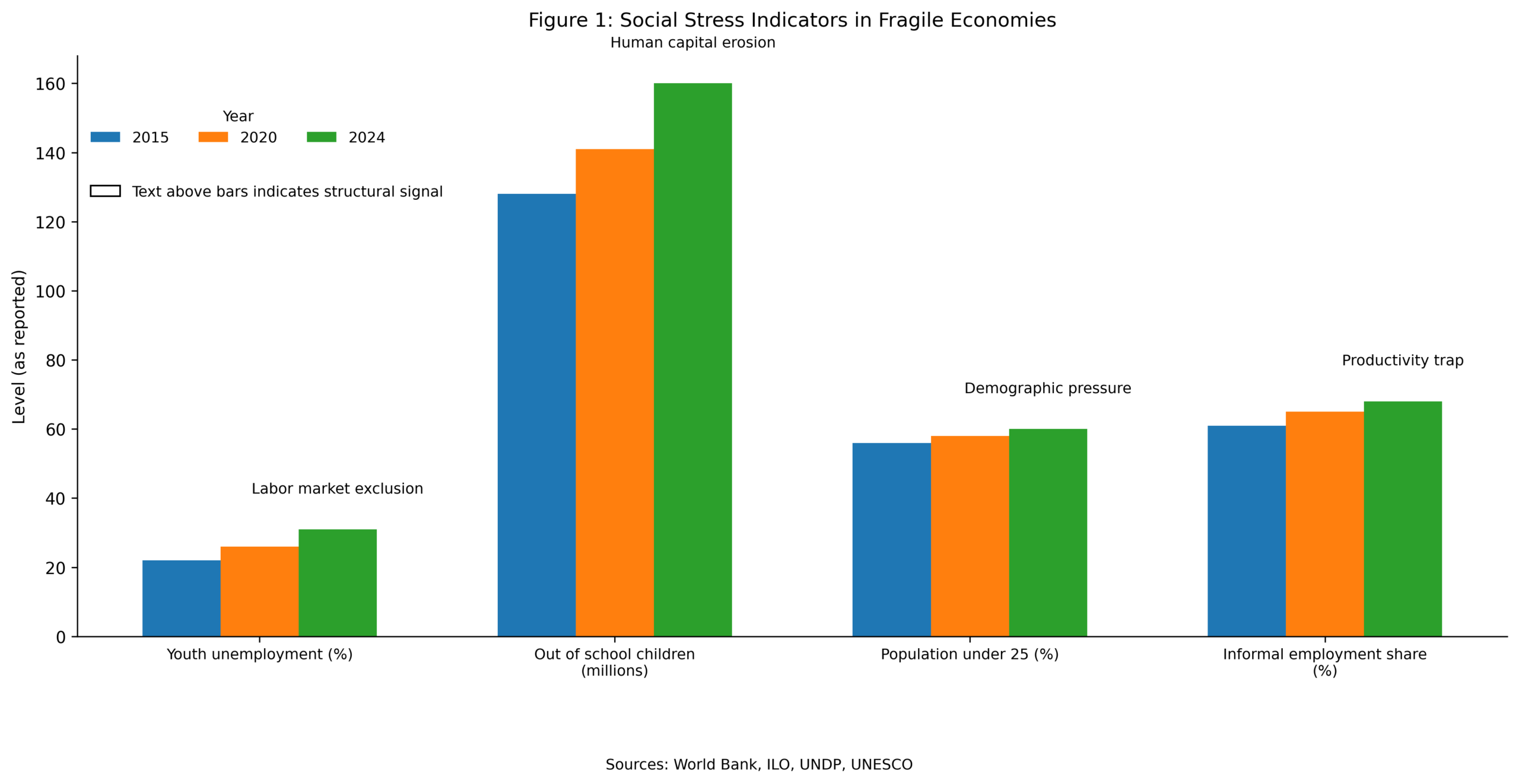

- Youth unemployment in fragile states exceeds 30% on average

- 41 countries face active internal or border security disruptions

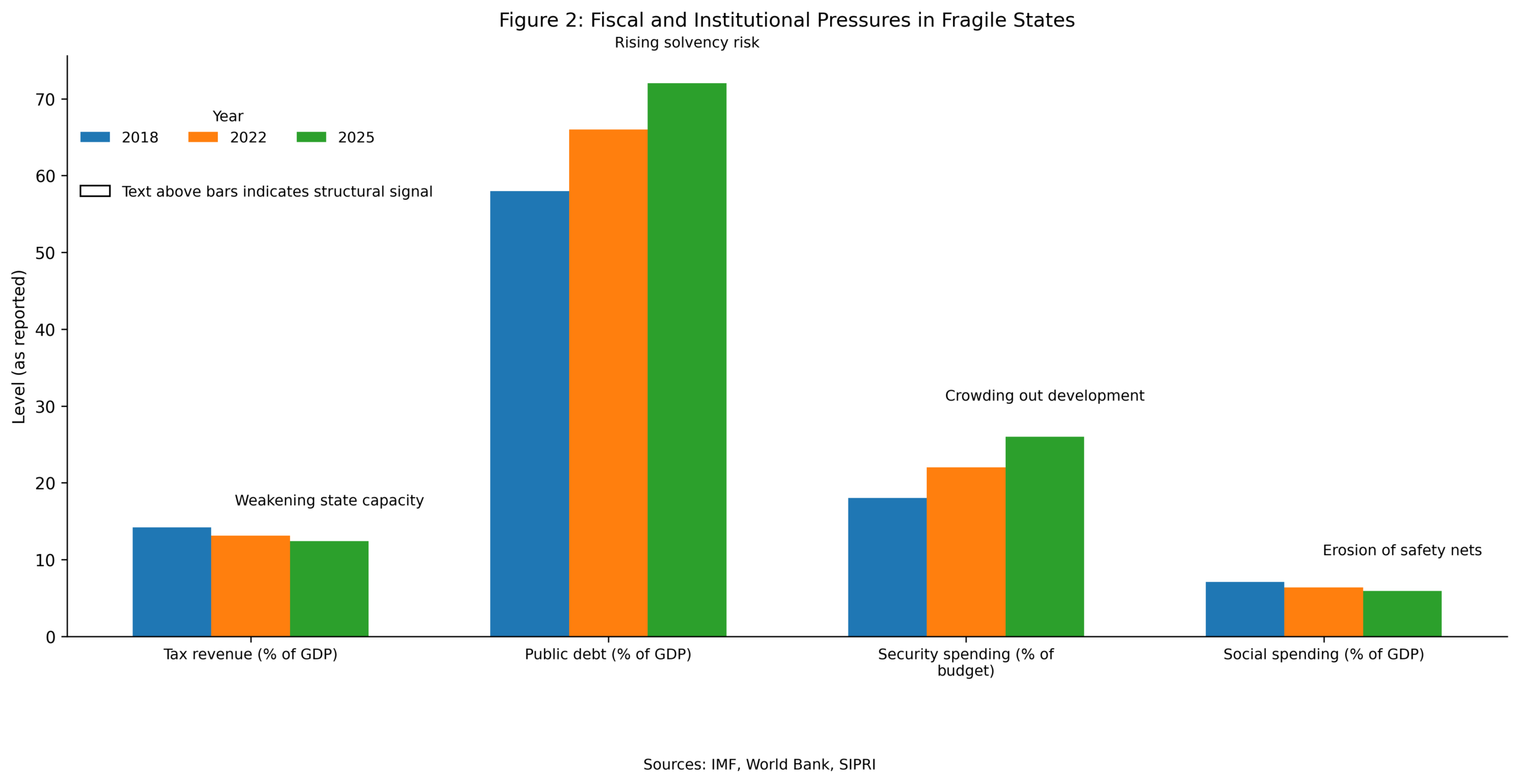

- Average public debt in fragile economies is near 72% of GDP

Political Economy of Fragility as a Global Signal

State fragility and economic spillovers are no longer confined to post-conflict environments. Instead, they are increasingly emerging through gradual institutional erosion and declining public service delivery. In many cases, social stress appears before macroeconomic indicators begin to weaken. For example, demographic pressure and youth vulnerability often signal early fragility risks, well before output contractions become visible. In this sense, social indicators function as leading signals of deeper institutional strain, as highlighted in recent regional analysis https://economiclens.org/kp-social-crisis-demographic-stress-youth-vulnerability-and-human-collapse/.

As fragility deepens, coordination failures tend to multiply across the economy. Consequently, public institutions lose credibility, enforcement capacity weakens, and informal systems increasingly replace formal governance structures. Over time, these dynamics raise transaction costs and, in turn, reduce investment confidence. Because of this, international assessments now classify fragility as a macroeconomic risk rather than solely a development concern. Notably, this reclassification reflects fragility’s ability to generate sustained instability and transmit cross-border spillovers across regions https://www.worldbank.org/en/topic/fragilityconflictviolence.

Governance Breakdown and Growth Instability in Emerging Economies

Governance breakdown increasingly translates into direct growth risk rather than administrative inefficiency. Institutional decay weakens policy credibility and disrupts regulatory enforcement. As governance capacity erodes, both fiscal and monetary tools lose effectiveness. Even well designed stabilization measures deliver limited results.

Security volatility and border disruptions further amplify these effects. Markets fragment and regional integration weakens. Evidence from fragile regions shows that institutional decay combined with security stress discourages private investment and suppresses productivity over extended periods https://economiclens.org/kp-governance-crisis-security-turmoil-border-disruptions-and-institutional-decay/.

Weak institutional capacity also limits the impact of international support programs, as highlighted by the IMF https://www.imf.org/en/Topics/governance

Social Collapse and Labor Market Erosion

Social collapse amplifies economic fragility through multiple, interconnected channels. First, rising youth unemployment weakens household income formation and undermines consumption stability. At the same time, expanding informality reduces tax capacity and erodes labor protection. Meanwhile, demographic pressure intensifies competition for limited jobs and public services. Taken together, these forces generate long-lasting labor market scarring and, as a result, weaken medium-term growth potential. Accordingly, global labor assessments increasingly recognize youth exclusion as a structural macroeconomic constraint

https://www.ilo.org/global/topics/youth-employment/lang–en/index.htm

Security Shocks and Economic Fragmentation

Security disruptions increasingly affect economic activity through border closures, trade interruptions, and internal displacement. Rather than operating as temporary shocks, these disruptions persist and accumulate over time. Consequently, transport corridors become unreliable and supply chains fragment. In response, firms reduce exposure, delay investment, or exit fragile markets altogether.

Over time, insecurity reshapes economic geography in a cumulative manner. As conditions deteriorate, investment concentrates in relatively safer enclaves, while peripheral regions fall further behind. Moreover, persistent insecurity disrupts trade corridors and labor mobility, thereby reinforcing economic fragmentation across fragile regions

https://www.unodc.org/unodc/en/data-and-analysis/conflict.html

Institutional Decay and Fiscal Stress

Fiscal systems in fragile states increasingly operate in crisis mode. Resources shift toward security and emergency spending. Development investment declines. Persistent poverty expansion and corruption exposure weaken revenue mobilization and fiscal credibility https://economiclens.org/kp-economic-crisis-poverty-corruption-pressures-and-financial-strain/.

Rising debt burdens further constrain fiscal space and limit stabilization capacity https://www.imf.org/en/Topics/debt

Fragility Spillover Risks Over the Next 12 Months

Under the baseline scenario, fragile economies experience subdued growth alongside recurring social and security disruptions. At the same time, institutional recovery remains limited, constraining policy effectiveness. By contrast, the downside scenario assumes escalating insecurity and fiscal exhaustion. In this case, wider instability, capital flight, and humanitarian stress emerge, thereby increasing regional spillovers. Conversely, the upside scenario reflects partial stabilization and targeted institutional support. Even so, recovery remains uneven and gradual, limiting short-term macroeconomic improvement.

Second-Order Effects of State Fragility and Economic Spillovers

Beyond immediate impacts, persistent fragility generates second-order effects that extend across national borders. As livelihoods deteriorate, migration pressures rise. Simultaneously, trade disruptions increasingly affect neighboring economies. In addition, external financing dependence expands as domestic fiscal capacity weakens. Over time, state fragility and economic spillovers become embedded in regional macroeconomic dynamics, rather than remaining isolated national failures.

Expert Insight: Institutional Assessments on Fragility Risks

Across institutions, there is growing convergence around the view that state fragility and economic spillovers represent binding macroeconomic constraints.

For instance, the World Bank highlights the concentration of poverty and instability in fragile settings and the resulting global spillovers

https://www.worldbank.org/en/topic/fragilityconflictviolence.

Similarly, the IMF warns that governance erosion undermines stabilization capacity, debt sustainability, and policy credibility

https://www.imf.org/en/Topics/governance.

At the same time, the OECD emphasizes growing spillovers from fragile states into migration flows, trade disruption, and regional security risks

https://www.oecd.org/dac/conflict-fragility-resilience/.

Meanwhile, the ILO stresses that youth unemployment and labor exclusion in fragile economies are becoming structural constraints on growth

https://www.ilo.org/global/topics/youth-employment/lang–en/index.htm.

The Forward Curve for Fragility Risks

Looking ahead, several indicators warrant close monitoring. In particular, youth unemployment and school dropout rates provide early warning signals. In parallel, trends in security incidents and border disruptions reveal evolving instability. Equally important, tax revenue performance and the compression of social spending reflect fiscal stress. Finally, rising regional spillover intensity captures the externalization of fragility risks.

Bottom Line

In conclusion, state fragility and economic spillovers are no longer peripheral development concerns. Instead, they constitute central macroeconomic risks shaping growth trajectories, fiscal stability, and regional security. As governance capacity continues to erode and social pressures intensify, state fragility and economic spillovers are likely to remain defining constraints on economic outcomes across much of the developing world throughout the decade.