Trade routes weaponization is no longer a theoretical framework debated in academic circles. Instead, it has become a lived reality of global commerce. Shipping lanes, canals, and maritime chokepoints once symbolized efficiency and interdependence. Today, however, they increasingly function as instruments of pressure, disruption, and strategic signaling.

At first glance, global trade volumes continue to move. World Trade Organization monitoring confirms this surface-level continuity (https://www.wto.org). Yet beneath this apparent stability, a deeper transformation is underway. Under trade routes weaponization, logistics corridors no longer respond primarily to cost minimization or efficiency gains. Rather, threat perception, insurance risk, naval presence, and political bargaining now shape routing decisions.

Crucially, this shift does not represent a temporary distortion of globalization. On the contrary, it signals a structural reordering of how states and non-state actors exercise economic power through physical infrastructure.

When Trade Routes Stop Being Neutral

For decades, policymakers and market participants treated shipping lanes as neutral economic infrastructure. This assumption rested on freedom of navigation principles promoted by the International Maritime Organization (https://www.imo.org). Today, that premise no longer holds.

The Red Sea illustrates this transformation with striking clarity. What once functioned as a routine transit corridor now operates as a contested space. Security risk dictates routing choices. Consequently, insurance premiums surge, transit times lengthen, and supply chains internalize political risk well before markets fully reprice it.

EconomicLens analysis on Red Sea shipping inflation and global trade stability demonstrates how rapidly these risks have become embedded in logistics decision-making (https://economiclens.org/red-sea-shipping-inflation-and-global-trade-stability/). As a result, disruption shifts from being exceptional to persistent. Once that threshold is crossed, neutrality erodes. That is precisely how trade routes weaponization takes root.

Evidence That Trade Routes Weaponization Is Structural

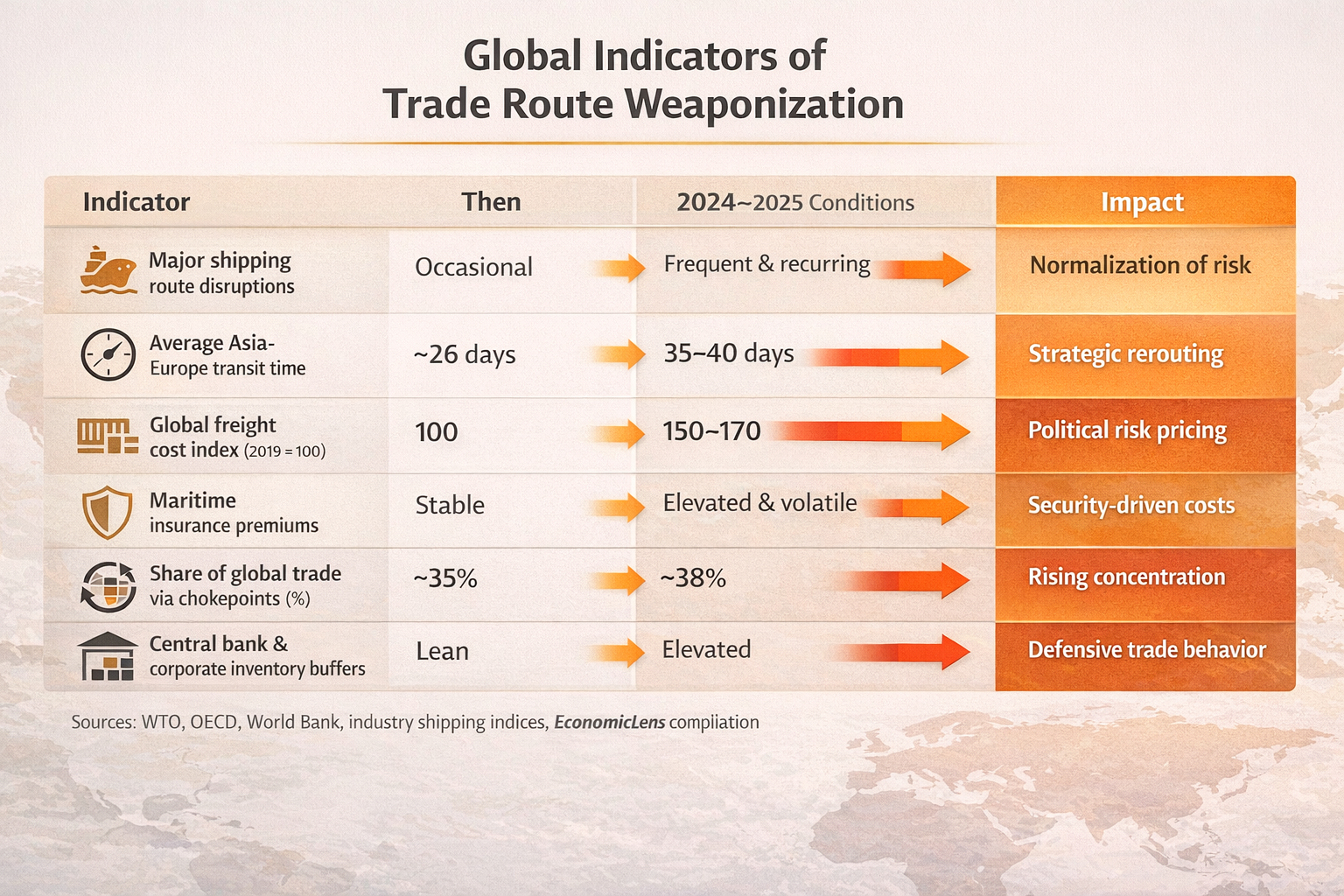

Opinion must rest on evidence. Increasingly, the data supports a clear conclusion. Trade routes weaponization no longer appears episodic or crisis-driven. Instead, it has become systemic, embedded within the operating logic of global trade itself.

These indicators do not describe a system merely under stress. Instead, they describe a system that has already adapted to permanent political risk embedded directly within trade infrastructure.

Maritime Chokepoints and the Logic of Trade Routes Weaponization

Maritime chokepoints such as the Suez Canal clearly illustrate how trade routes weaponization transmits economic shocks across borders. When disruption occurs near the canal, vessels reroute around the Cape of Good Hope. As a result, transit times extend, fuel consumption rises, and operating costs climb.

Moreover, EconomicLens coverage of Red Sea turmoil and Suez Canal disruptions documents how these shocks cascade through freight markets, insurance pricing, and delivery schedules (https://economiclens.org/red-sea-turmoil-suez-canal-disruptions-and-the-global-shipping-shock/). At the same time, the OECD warns that chokepoint instability amplifies systemic trade volatility rather than containing it within specific routes (https://www.oecd.org).

Consequently, control or even a credible threat around a narrow corridor now reshapes prices, bargaining power, and macroeconomic outcomes simultaneously.

The Red Sea Crisis Shows How Trade Routes Fuel Inflation

The Red Sea shipping crisis highlights one of the most direct consequences of trade routes weaponization. In this environment, logistics disruption feeds inflation faster and more broadly than in previous trade shocks.

Longer routes increase fuel demand. Meanwhile, insurance premiums rise alongside perceived risk. In addition, delivery delays force firms to hold larger inventories. Each adjustment adds cost, and firms increasingly pass those costs through to final prices.

EconomicLens analysis of the Red Sea shipping crisis and its global trade fallout traces how these pressures spread across regions and income groups (https://economiclens.org/red-sea-shipping-crisis-global-trade-fallout-inflation-pressure-and-supply-chain-turmoil/). Consistent with this pattern, the World Bank confirms that logistics shocks now transmit inflation across borders rather than remaining localized (https://www.worldbank.org).

In this context, inflation no longer reflects purely monetary dynamics. Instead, it increasingly emerges from logistical and geopolitical constraints.

Energy Corridors Deepen Trade Routes Weaponization

However, container trade captures only part of the story. Energy shipping lanes deepen trade routes weaponization through their concentration and vulnerability.

Oil and gas corridors in the Middle East now operate under persistent naval presence, geopolitical signaling, and elevated security risk. EconomicLens analysis of Middle East oil shipping vulnerability shows how concentrated flows raise global price sensitivity toward 2026 (https://economiclens.org/middle-east-oil-shipping-vulnerability-and-2026-price-risks/). Similarly, the International Energy Agency continues to warn that instability in energy transport routes magnifies supply volatility rather than smoothing it (https://www.iea.org).

As a result, when energy logistics become conditional, pricing power shifts unevenly across economies.

Climate Stress Turns Infrastructure Limits Into Leverage

Finally, climate stress adds another structural layer to trade routes weaponization. Canals depend on water availability, yet droughts and declining reservoir levels increasingly constrain transit capacity. World Bank climate assessments document this growing vulnerability in major waterways (https://www.worldbank.org).

When capacity becomes scarce, technical constraints quickly transform into economic leverage. Therefore, climate volatility reinforces geopolitical risk instead of offsetting it.

Policy Implications in an Era of Trade Routes Weaponization

Taken together, these dynamics point to clear policy implications:

-

Shipping lanes and canals must be treated as strategic economic assets

-

Trade strategy should prioritize resilience over peak efficiency

-

Inflation frameworks need to integrate logistics, insurance, and security risk

-

Smaller economies require regional coordination to reduce chokepoint exposure

Ignoring these shifts does not preserve globalization. Rather, it misreads the system that now governs global trade.

Editorial Verdict

Trade routes are no longer neutral infrastructure. They now function as instruments of power.

Trade routes weaponization represents a decisive break from the assumptions that once structured global commerce. In this environment, inflation, growth, and stability depend as much on geopolitics, logistics security, and climate stress as on supply and demand. Efficiency still matters, yet it no longer dominates decision making.

Ultimately, this is the world trade now inhabits, whether policymakers are prepared for it or not.