Global growth divergence 2026 shows emerging economies sustaining stronger momentum than advanced peers as tight financial conditions, aging demographics, and weak investment weigh on rich economies. Using IMF and World Bank data, this analysis explains why global growth paths are diverging and what it means for policy and markets.

Introduction

Global growth divergence 2026 has emerged as one of the defining patterns of the current global economy. While global GDP continues to expand, growth momentum is increasingly uneven across regions. Emerging economies are maintaining stronger expansion rates, while advanced economies remain constrained by structural and cyclical headwinds.

This divergence explains why global growth feels slower despite positive headline numbers, a theme explored in detail in Global economic slowdown 2026: why growth feels slower (https://economiclens.org/global-economic-slowdown-2026-why-growth-feels-slower/). Rather than a synchronized downturn, the world economy is moving along fragmented growth paths.

Emerging Market Growth Advantage

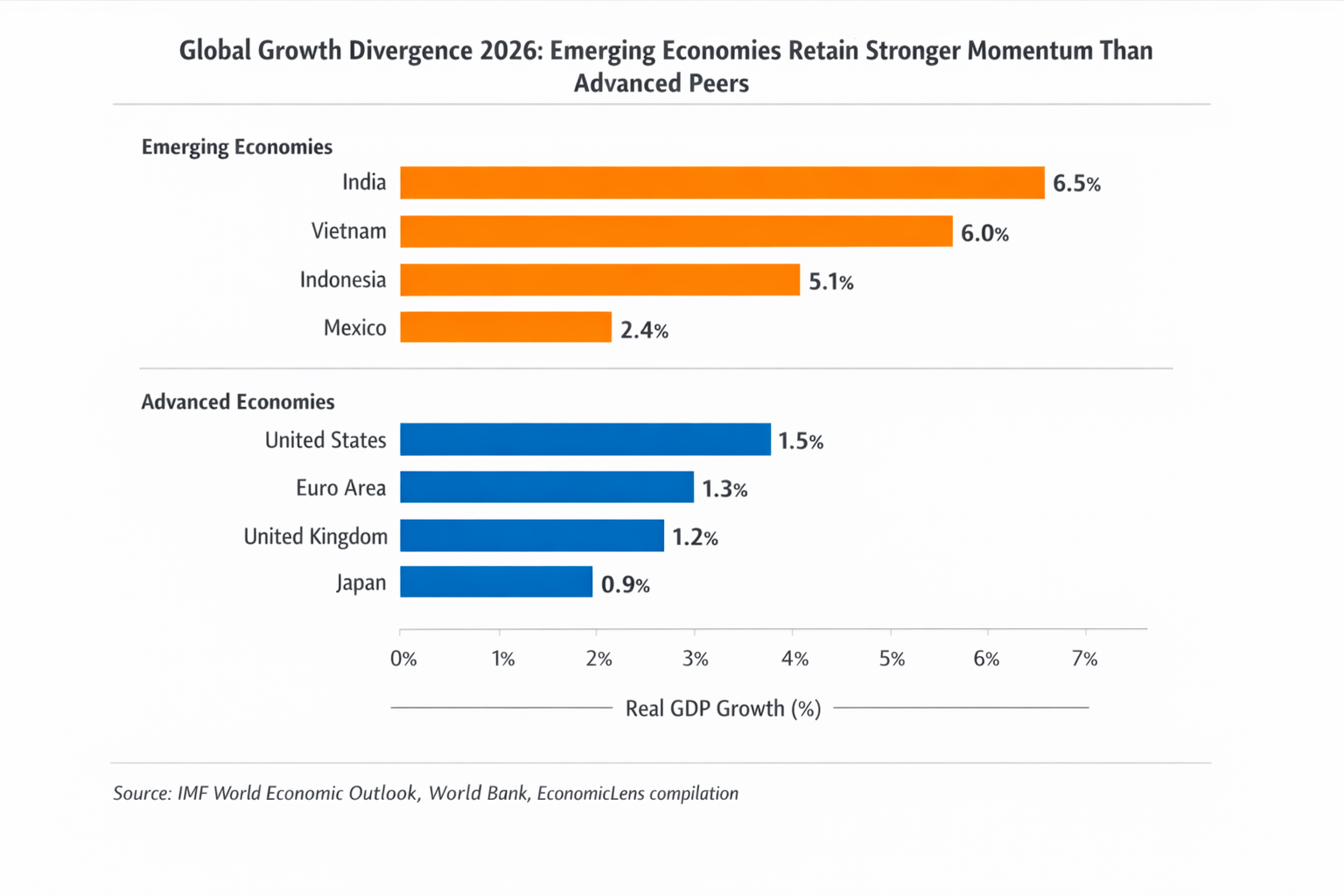

Emerging economies are expected to lead global expansion in 2026. India, Vietnam, Indonesia, and Mexico all post growth rates well above the advanced economy average. This emerging market growth advantage reflects a combination of favorable demographics, investment inflows, and expanding manufacturing capacity.

Moreover, supply chain diversification continues to benefit several Asian economies. According to the IMF World Economic Outlook (https://www.imf.org/en/Publications/WEO), emerging markets account for the majority of incremental global growth, even as global trade volumes remain subdued.

Advanced Economy Slowdown and Structural Constraints

In contrast, advanced economies face a clear slowdown. The United States, Euro Area, United Kingdom, and Japan are growing near or below 1.5 percent. This advanced economy slowdown is driven by tight financial conditions, aging populations, and weak productivity growth.

Although inflation has moderated, real interest rates remain elevated. As a result, investment recovery has been slow. The World Bank notes that high borrowing costs continue to suppress capital formation in advanced economies (https://www.worldbank.org).

Global Growth Gap vs Synchronized Stagnation

Importantly, global growth divergence 2026 does not imply a synchronized stagnation. Instead, it highlights a widening gap between regions. This distinction matters for policy interpretation.

The risk of misdiagnosis is discussed in Global growth slowdown 2025–2026: are major economies sliding into a synchronized stagnation? (https://economiclens.org/global-growth-slowdown-2025-2026-are-major-economies-sliding-into-a-synchronized-stagnation/). While advanced economies face persistent weakness, emerging markets continue to provide a growth anchor for the global economy.

Divergent Global Growth Paths and Policy Implications

These divergent global growth paths complicate global policy coordination. Advanced economies must balance inflation control with growth support, while emerging economies face capital flow volatility and external financing risks.

At the same time, the OECD highlights that structural reforms, productivity investment, and labor market adaptability remain critical for sustaining long-term growth (https://www.oecd.org). Without such reforms, growth divergence could become entrenched beyond 2026.

What Global Growth Gap Means Going Forward

Looking ahead, global growth divergence 2026 is likely to persist unless financial conditions ease materially or productivity improves in advanced economies. Emerging markets will continue to drive global expansion, but they are not immune to external shocks.

Ultimately, the central challenge for policymakers is not preventing recession, but managing an increasingly uneven global recovery. Understanding this divergence is essential for realistic growth forecasts, effective policy design, and informed investment decisions.