The KP economic crisis is deepening as poverty rises, household deprivation grows and corruption pressures intensify. Rising inflation, border disruptions and shrinking job opportunities have pushed millions into financial stress. This blog explains how economic shocks, fiscal leakages and market instability are turning Khyber Pakhtunkhwa into a long-term economic emergency.

Introduction: Emerging Scale of the KP Economic Crisis

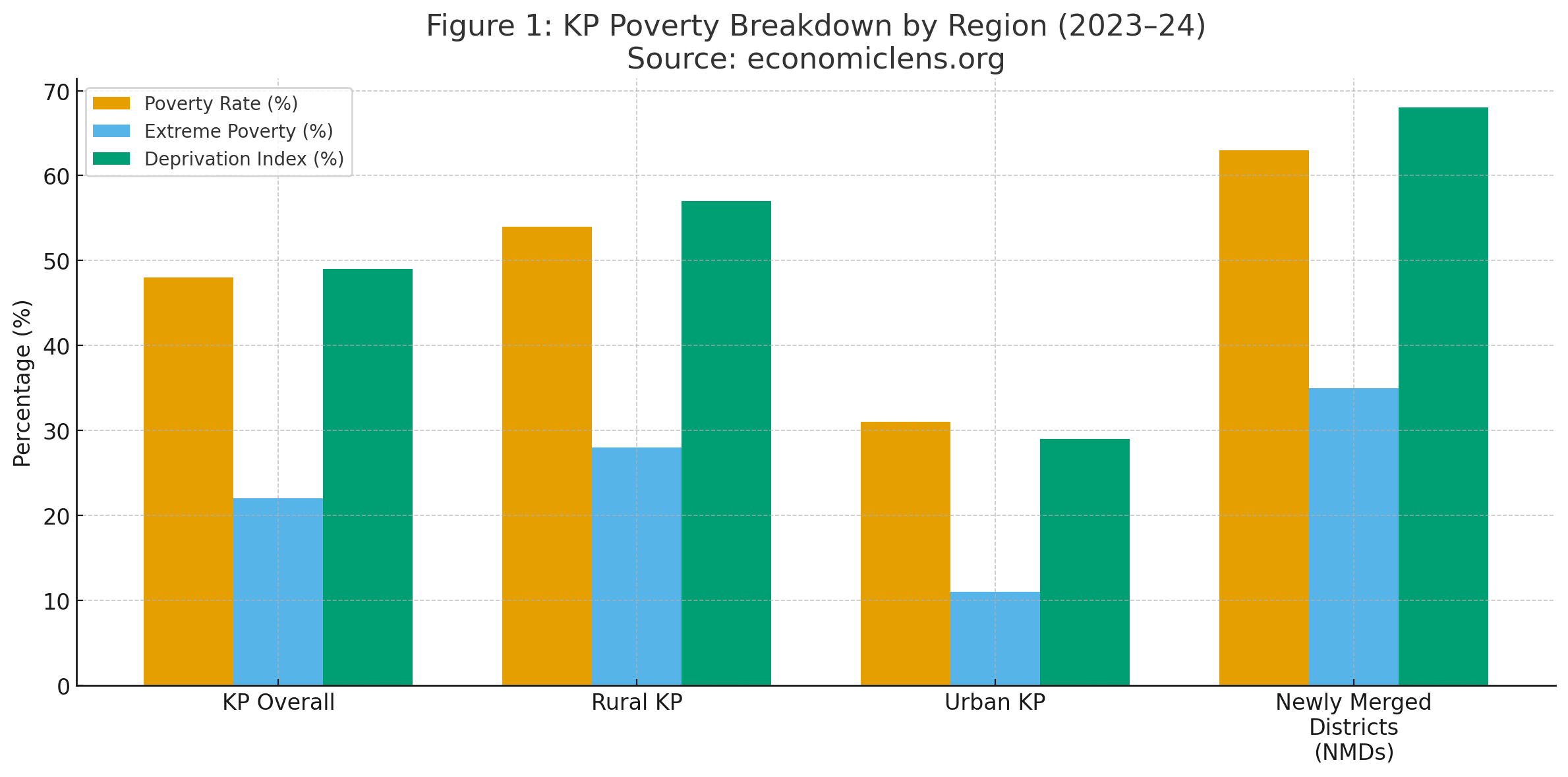

The KP economic crisis is spiraling faster than any official outlook predicted. Poverty has surged to 48 percent across the province, while household deprivation has reached 49 percent. Inflation on essential goods has climbed to 34 percent and pushed millions of families into survival mode. What once appeared as a routine slowdown has become a province-wide breakdown of purchasing power, economic stability and livelihoods.

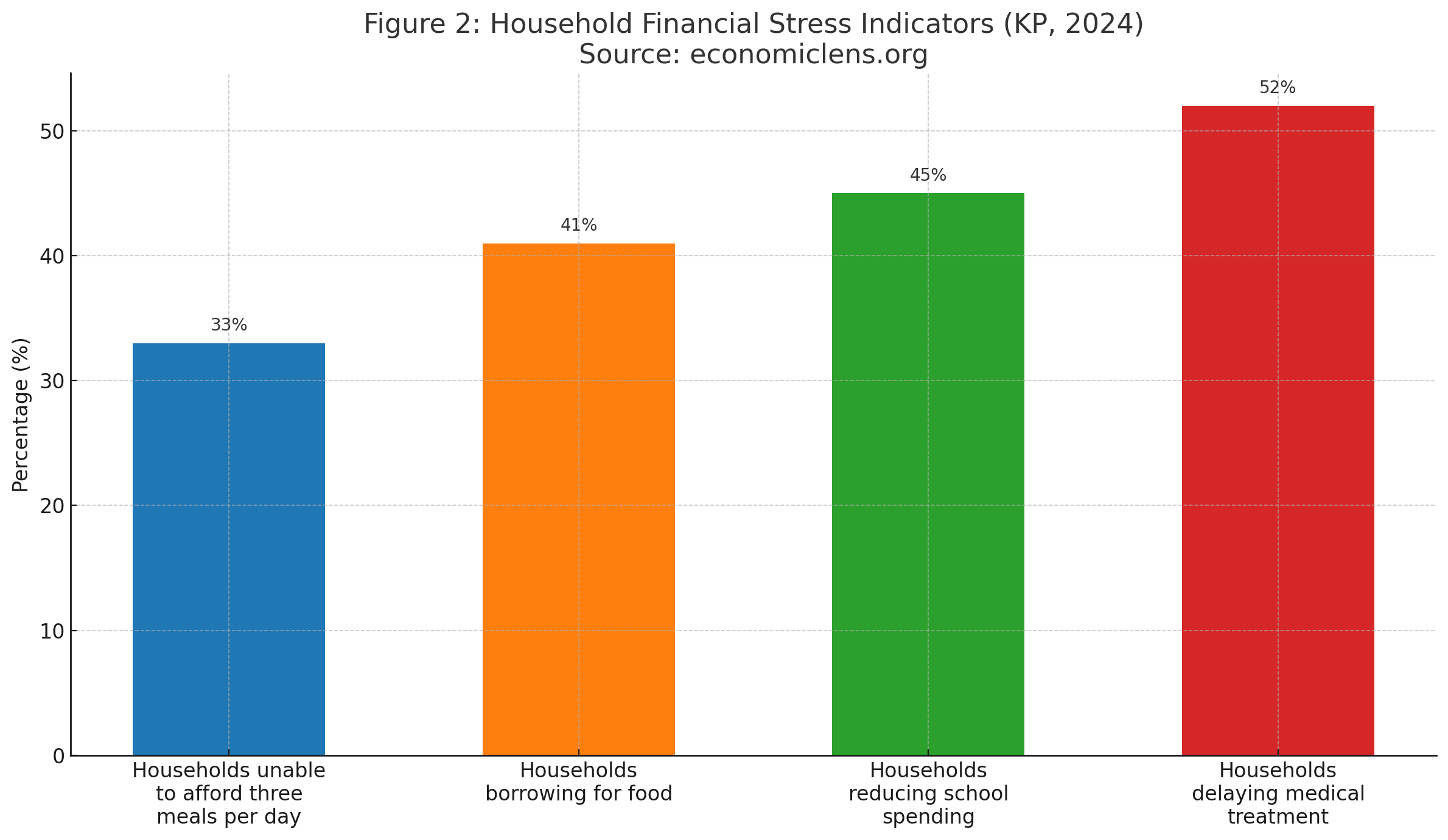

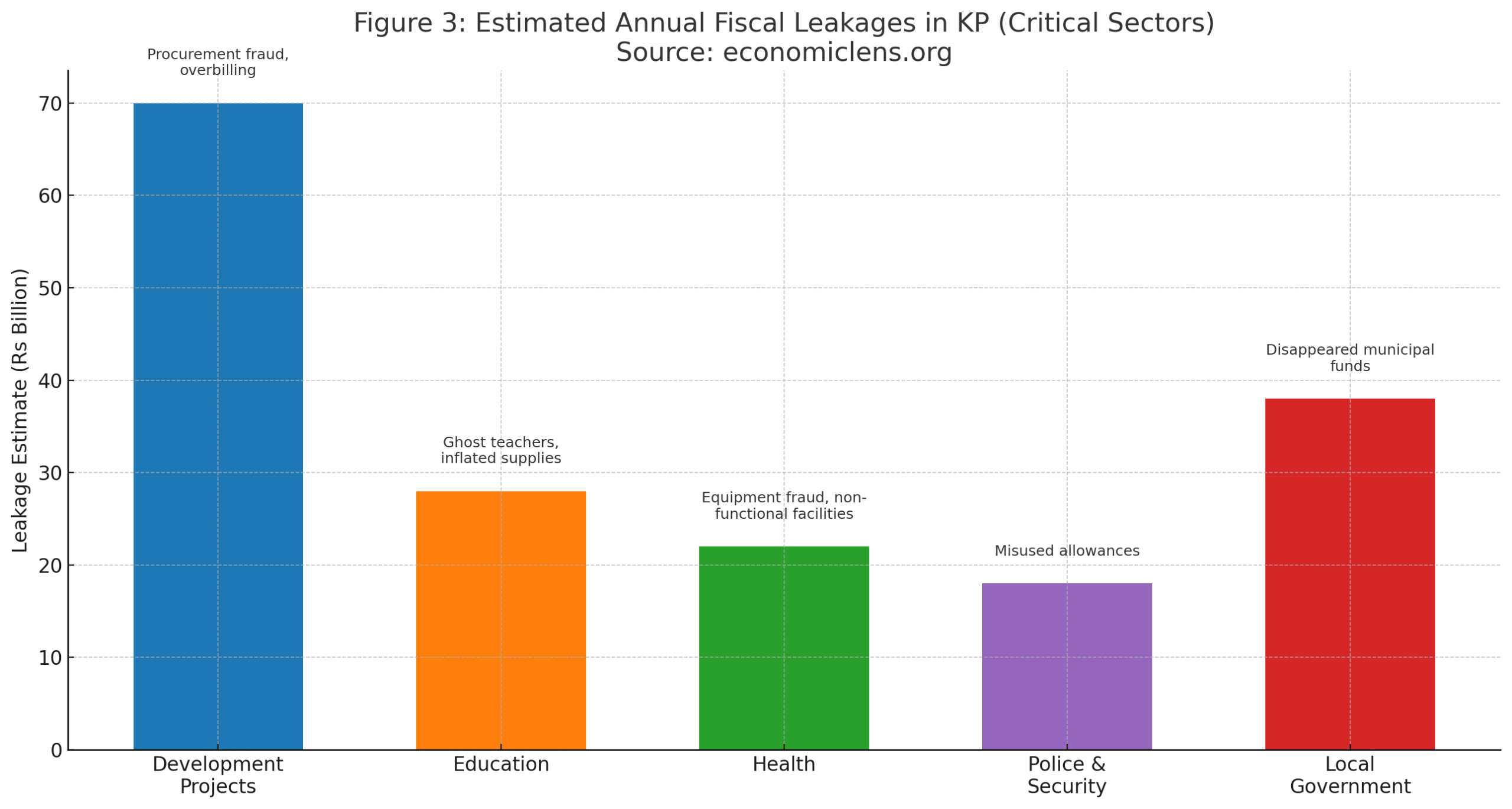

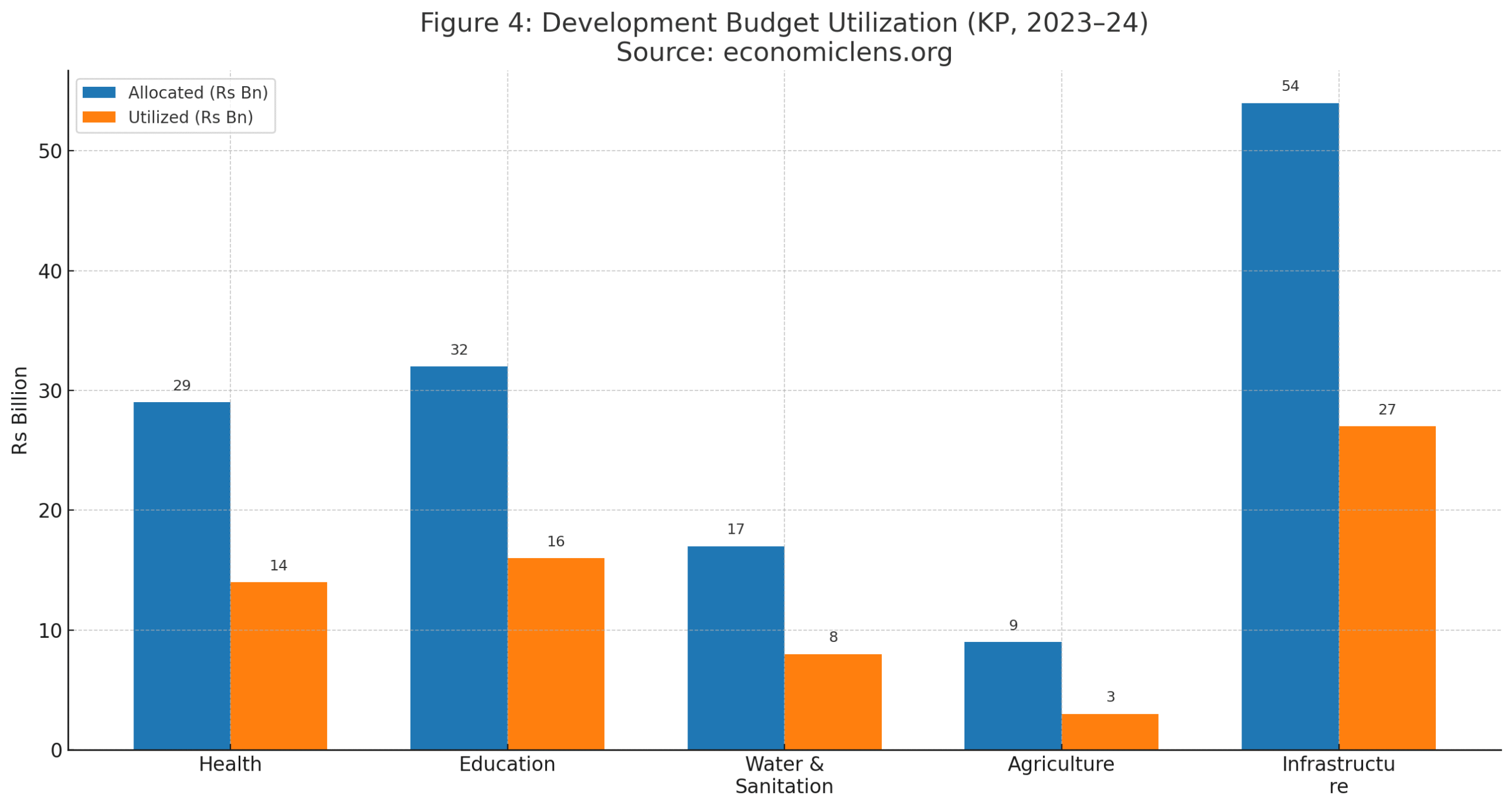

Daily life is collapsing under pressures that were once confined to technical reports. Forty-one percent of households now borrow money simply to buy food, while thirty-three percent cannot afford three meals a day. Around fifty-two percent of families delay medical treatment because healthcare has become financially unreachable. At the same time, corruption drains Rs 176 to 200 billion every year, leaving development budgets depleted long before they reach communities.

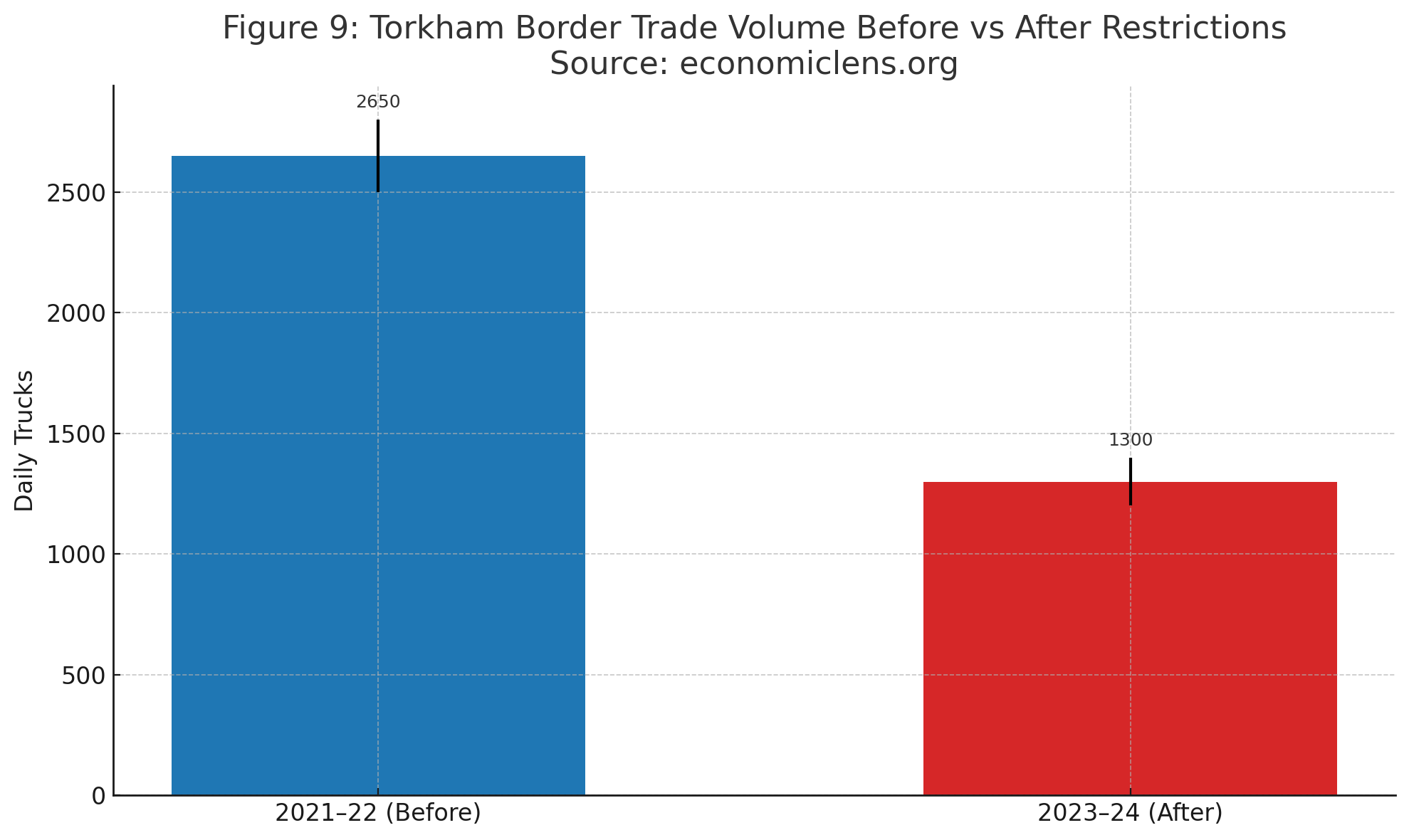

Border disruptions have reduced Torkham’s daily truck movement by almost 48 percent, choking local trade and destroying incomes for thousands of traders and transport workers. Youth unemployment stands at 28 percent across the province, while female youth joblessness has crossed 40 percent. Economic stagnation has evolved into a generational crisis. This is the reality of the KP economic crisis. It is not a temporary downturn. It reflects a structural unraveling of economic life for 40 million people.

1: Poverty Surge and Household Hardship Under the KP Economic Crisis

Poverty in KP has intensified into a full-scale emergency. One in every two households now lives below the poverty line. In the newly merged districts, poverty has reached an alarming 63 percent. Multidimensional deprivation has risen to 68 percent, placing these regions among South Asia’s most fragile areas. The KP economic crisis is no longer defined by prices alone. Survival capacity is collapsing as thirty-three percent of families cannot afford three meals. At the same time, forty-five percent have reduced education spending to cope with inflation.

UNDP’s Multidimensional Poverty Index shows poverty accelerates when education, health and consumption decline together. KP’s rural and merged districts now reflect this pattern clearly. The UNDP South Asia poverty findings (https://www.undp.org/south-asia) show inflation shocks deepen deprivation when social protection systems lag behind. This dynamic explains why inflation has rapidly intensified poverty across the province.

The World Bank’s South Asia Poverty Update (https://www.worldbank.org/poverty) warns that inflation-driven poverty often becomes structural when household incomes stagnate. This mirrors KP’s rising deprivation levels and growing urban-rural inequality. Once incomes fail to recover, poverty is harder to reverse.

The FAO Global Food Security Monitor (https://www.fao.org/global-food-security) confirms food inflation hits vulnerable households the hardest. In developing economies, families respond through severe consumption cuts. KP’s 34 percent food inflation reflects this pattern clearly. Families are reducing nutrition, healthcare access and schooling to survive.

These global signals deepen the understanding of why poverty is accelerating under the KP economic crisis, as inflation, income stagnation and corruption-driven leakages converge.

Commentary

These numbers reveal a poverty crisis expanding faster than the province’s social protection systems can respond. The surge in deprivation across rural and merged districts shows that household resilience has weakened sharply. Rising costs and collapsing real wages have eroded families’ ability to cope. Persistent inflation forces severe cuts in nutrition, education and healthcare.

Moreover, the rapid increase in borrowing for food signals the breakdown of financial stability at the household level. With incomes stagnating and employment opportunities shrinking, poverty is no longer a temporary shock. It is now a long-term structural feature of the KP economic crisis. Inequality is widening and community wellbeing is weakening.

Global Spotlight on Poverty Collapse

Kenya’s food inflation surge offers a strong global parallel to KP’s poverty crisis. World Bank data shows Kenya’s food inflation averaged 31 percent in 2023. This surge pushed millions into hunger and forced sharp cutbacks in education and healthcare spending. The IMF reports that nearly half of Kenyan households borrowed money for essential consumption. This pattern mirrors KP, where forty-one percent of families borrow to buy food. Kenya’s rural regions suffered the steepest purchasing power losses due to high transport costs. Unstable supply chains further weakened household resilience. This experience reflects how the KP economic crisis deepens deprivation in districts with fragile markets and limited opportunity.

“If poverty continues rising at this speed, KP will enter a decade of irreversible human development losses that no relief effort or subsidy package can repair. The crisis is no longer emerging. It is unfolding in real time, and millions are already living its consequences.”

2: Corruption Pressures and Khyber Pakhtunkhwa Financial Stress

Corruption has become one of the most destructive forces deepening the KP economic crisis, draining an estimated Rs 176 to 200 billion annually from development projects, social services and public institutions. This financial leakage is not abstract. It directly translates into unfinished schools, non-functional hospitals, ghost teachers, incomplete roads and empty local government budgets. As corruption scales upward, the economic foundations of the province weaken downward, creating a widening gap between public spending and public outcomes.

Expert Insight & Report Spotlights

The World Bank Governance Indicators show that weak corruption controls slow development and weaken service delivery. The World Bank’s Governance and Corruption Report (https://www.worldbank.org/en/topic/governance) finds corruption can reduce development effectiveness by up to 30 percent. This aligns closely with KP’s repeated budget underutilization and persistent fiscal leakages.

The IMF Fiscal Transparency Handbook (https://www.imf.org/en/Publications) warns that corruption in procurement inflates project costs and delays infrastructure completion. KP’s chronic underuse of development budgets reflects this global pattern clearly. Delayed projects weaken public confidence and economic performance.

The Natural Resource Governance Institute (https://resourcegovernance.org) shows corruption in public finance erodes institutional trust. It also creates cycles of weak governance that are difficult to reverse. These findings mirror how fiscal leakages deepen the structural roots of the KP economic crisis.

Institutional fragility remains a core driver of the KP economic crisis. Similar weaknesses were highlighted in the EconomicLens analysis “27th Constitutional Amendment: Economic Shifts and Institutional Reforms Shaping the Future of Pakistan” (https://economiclens.org/pakistans-27th-constitutional-amendment-power-centralization-judicial-overhaul-the-new-civil-military-order). The analysis shows how weak administration, fragmented oversight and poor enforcement magnify economic risks in KP.

KP’s vulnerability is further shaped by broader macroeconomic pressures. The EconomicLens report “Global Economic Outlook 2025–2026: Slow Growth, Sticky Inflation and Rising Debt” (https://economiclens.org/global-economic-outlook-2025-2026-slow-growth-sticky-inflation-rising-debt) explains how inflation cycles and supply chain shocks affect provincial stability. Slowing global growth continues to influence KP’s inflation, trade flows and fiscal balance.

Commentary

The scale of fiscal leakages in KP shows corruption is not a side issue. It is the core economic malfunction driving the KP economic crisis. A development budget with fifty percent utilization leaves essential services undelivered. Infrastructure remains incomplete, and public trust continues to weaken. Losses in education and health show that social sectors bear the heaviest burden. These failures deepen long-term poverty and widen inequality across the province.

Fiscal leakages continue to weaken institutional capacity at every level. They reduce the government’s ability to respond to emergencies effectively. Authorities also struggle to maintain infrastructure and invest in growth sectors. Corruption absorbs resources equal to several years of development spending. As a result, KP’s economic trajectory is shaped by mismanagement rather than policy.

Global Spotlight on Fiscal Meltdowns

Sri Lanka’s fiscal meltdown provides a strong global comparison. IMF analysis shows the debt crisis intensified through corruption, mismanagement and inflated public spending. These forces hollowed out development budgets over time. The World Bank reports that decades of fiscal leakages weakened public services and contributed to the 2022 collapse. These leakages reduced the effectiveness of social spending by more than 35 percent. Service delivery suffered across multiple sectors as a result.

This experience mirrors the structural cracks within the KP economic crisis. Corruption-driven budget leakages erase the developmental impact of funds allocated on paper. Much of this spending never reaches communities on the ground.

“If fiscal leakages continue at this scale, KP will lose more to corruption than it spends on health, education and infrastructure combined. No economy can absorb this level of internal bleeding and still expect stability.”

3: Economic Crisis in KP: Deepening Strain on Households and Businesses

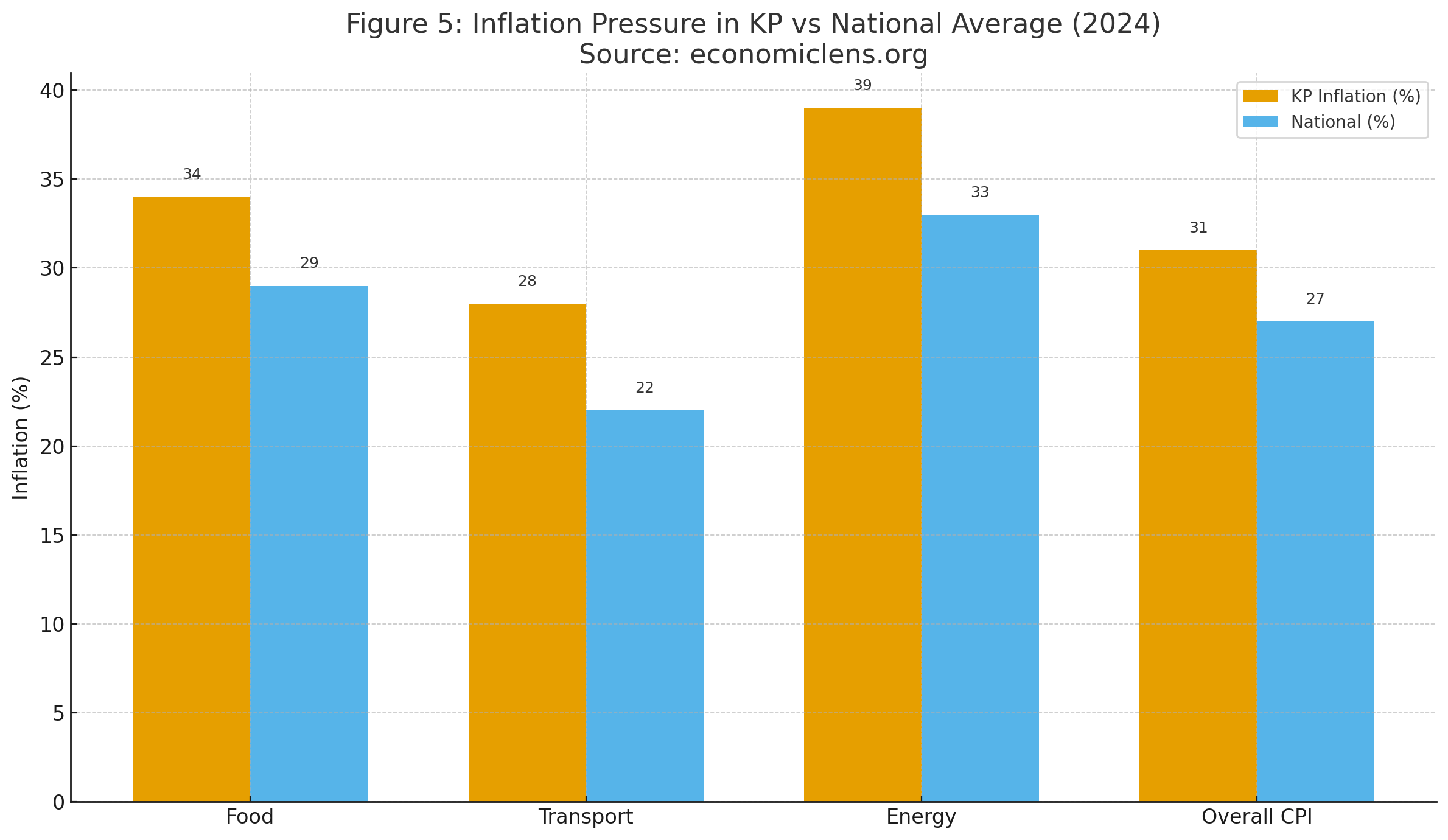

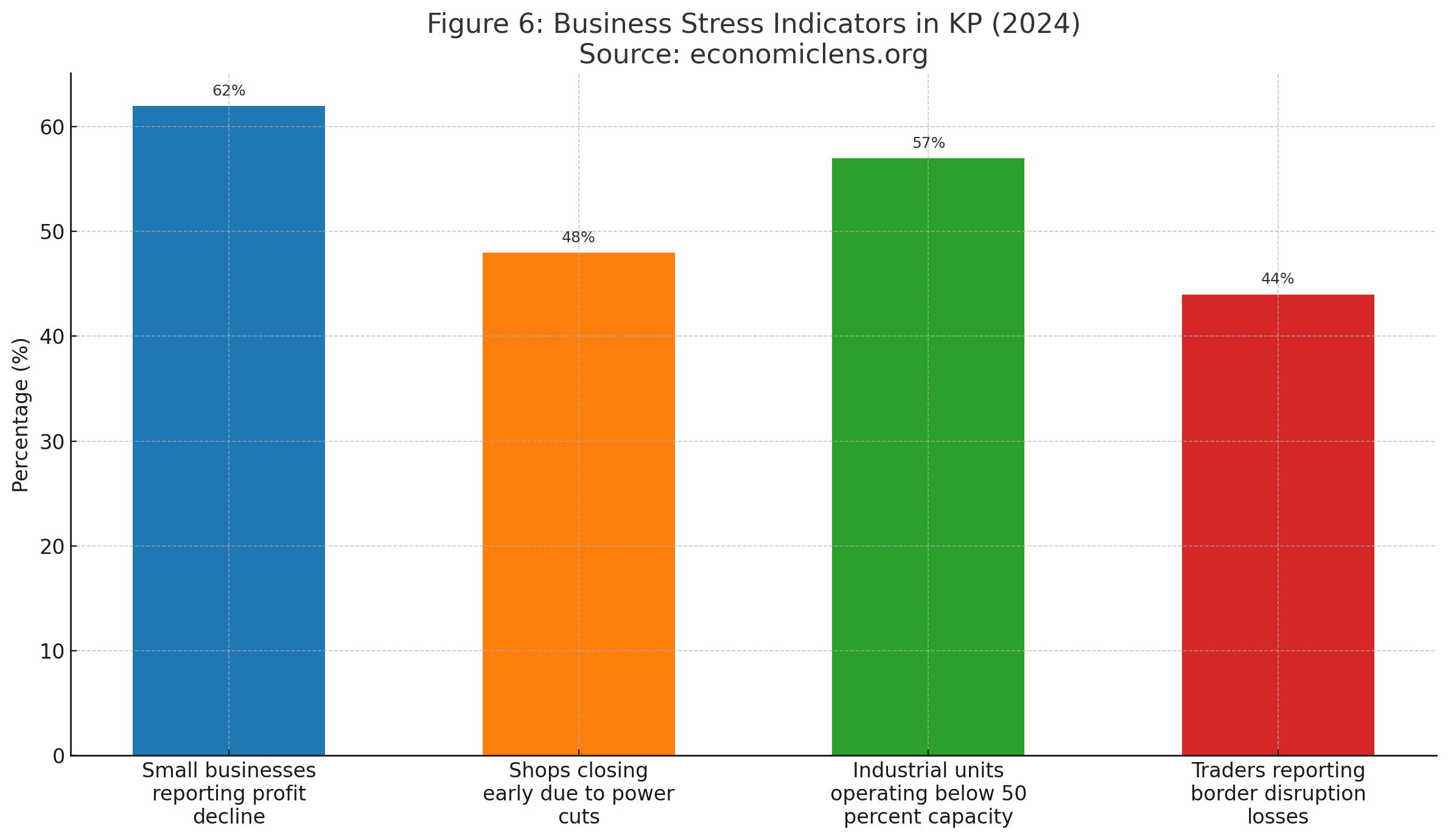

The economic strain gripping households and businesses in KP reflects the sharpest symptoms of the KP economic crisis. Inflation on essential goods has surged to 34 percent, transport costs have risen by 28 percent and energy inflation has reached 39 percent, squeezing household budgets from all sides. Simultaneously, more than 62 percent of small businesses report declining profits, and over 57 percent of industrial units now operate below half their capacity.

Expert Insights on Inflation and the KP Economic Crisis

The Asian Development Bank’s inflation and business resilience analysis (https://www.adb.org/publications) warns that prolonged inflation weakens consumer demand. It also pushes small enterprises into sustained contraction. KP’s declining market activity follows this pattern as purchasing power continues to erode.

The International Labour Organization’s World Employment Outlook (https://www.ilo.org/global/research) shows inflation-driven closures hit informal economies hardest. Small shops, vendors and transport workers carry most employment in such systems. KP’s heavy reliance on informal labor increases its exposure to this risk.

UNCTAD’s Trade and Development Report (https://unctad.org) confirms that cross-border slowdowns reduce liquidity in local markets. Disruptions such as reduced movement through Torkham trigger cascading business failures. These global patterns show how the KP economic crisis intensifies financial strain across households and markets.

Commentary

These indicators show a province under deep economic stress, where consumers cannot spend, businesses cannot sustain operations and industries cannot produce at scale. The inflation gap between KP and the national average shows deeper exposure to supply chain disruptions and high transport costs.

Shrinking margins, reduced working hours and operational challenges all signal deteriorating economic health. Combined with falling purchasing power, these trends create a dangerous loop. They intensify the KP economic crisis and accelerate business failures.

Global Spotlight on Economic Freefall

Lebanon’s economic collapse presents a powerful mirror to KP’s household and business stress. The World Bank identified Lebanon’s crisis as one of the worst globally since the 1850s, driven by currency collapse, inflation and loss of market confidence. Household purchasing power fell by more than 70 percent, and small businesses shut down at unprecedented rates due to energy shortages and cost escalation. These international dynamics resemble KP’s inflation-driven business contraction, where rising energy prices, border disruptions and declining demand push small enterprises toward survival mode.

“If inflation and business contraction continue at this pace, KP will face a market collapse that freezes investment, accelerates unemployment and pushes the province deeper into financial instability.”

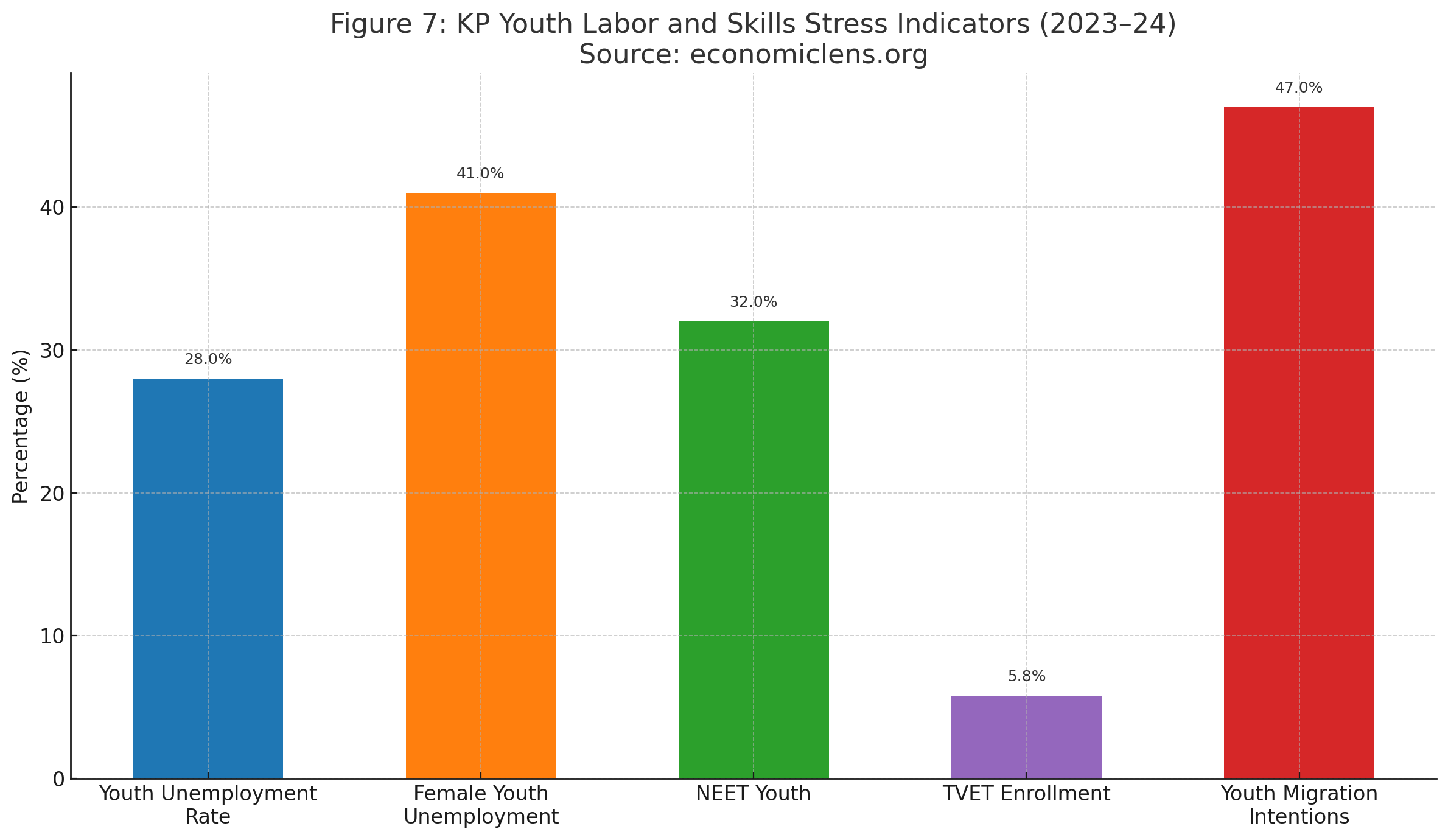

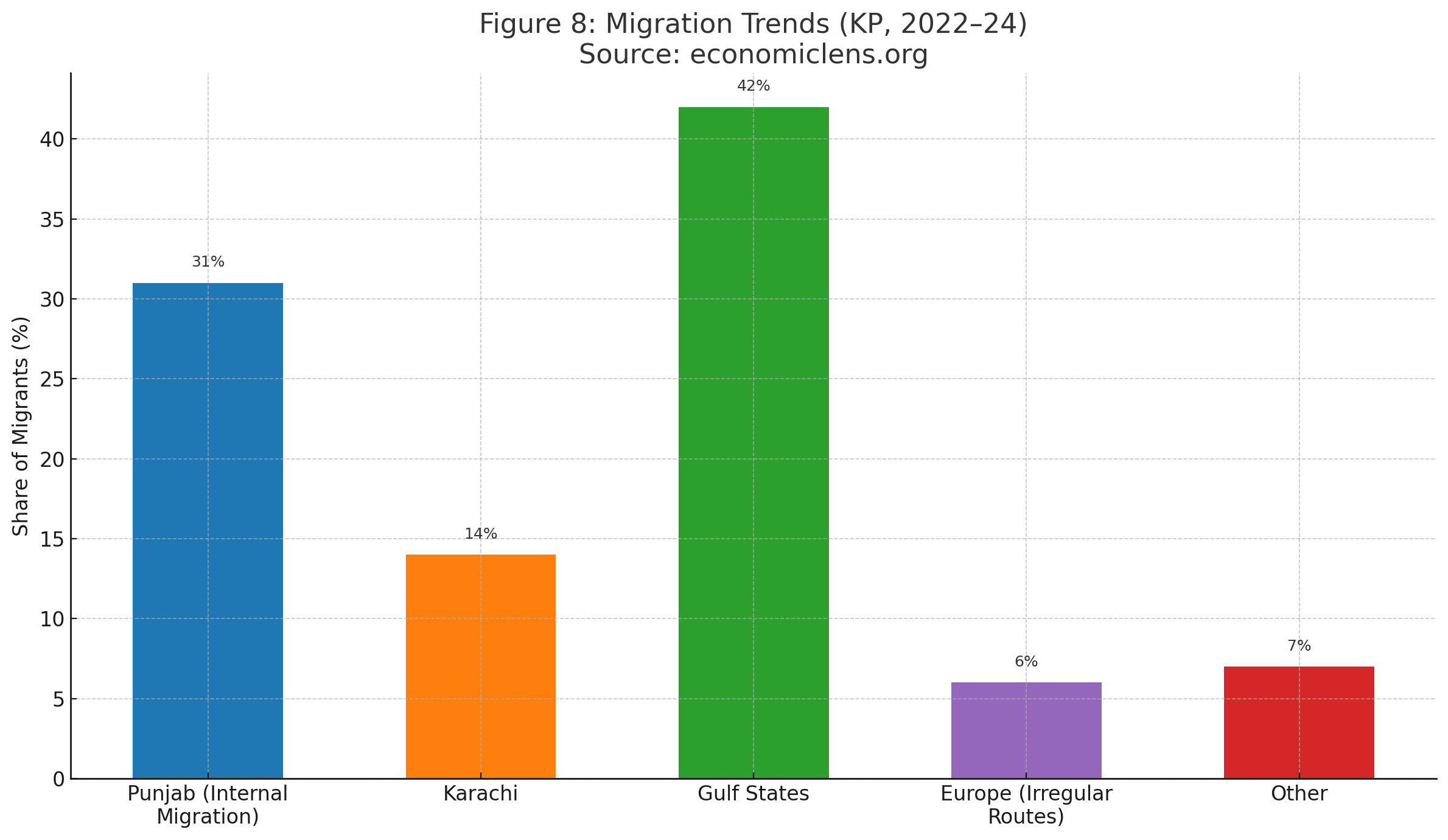

4: KP Economic Crisis and Youth Unemployment: Skills Gaps and Migration Pressures

The KP economic crisis has triggered a youth employment emergency. Unemployment has reached 28 percent among young people. Female youth unemployment has risen above 41 percent across the province. NEET rates now stand at 32 percent, showing one in three young people lacks work or education. Skills development pathways are collapsing rapidly. Only 5.8 percent of youth are enrolled in technical or vocational programs. Economic uncertainty continues to deepen across KP. Nearly 47 percent of young people now express strong intentions to migrate.

Expert Insights on Youth Labor Stress in the KP Economic Crisis

The International Labour Organization’s Global Employment Trends for Youth (https://www.ilo.org/global/publications) warns that youth unemployment above 25 percent often triggers long-term earning losses, delayed career development and heightened social instability. KP’s youth unemployment exceeds this threshold, placing it in a high-risk category.

The World Economic Forum’s Future of Jobs Report (https://www.weforum.org/reports) highlights how automation and skills mismatches reduce job opportunities in economies with weak technical education systems. KP’s lack of industry-aligned training intensifies the employment gap.

Moreover, UNDP’s Human Development Report (https://hdr.undp.org) notes that limited job creation in conflict-prone regions pushes youth toward migration, informal labor and unstable income sources. These global patterns reflect how the KP economic crisis is reshaping youth aspirations, employment outcomes and long-term social mobility.

Commentary

These indicators confirm a structural youth employment collapse. With NEET rates beyond 32 percent, KP’s young generation faces limited pathways into higher education or formal work. The gender gap, reflected in 41 percent female youth unemployment, shows deep institutional inequalities. Skills systems are failing to prepare youth for new job sectors. Many must rely on informal work or look for opportunities outside KP.

The surge in migration intentions to the Gulf and Punjab highlights diminishing confidence in the local economy. Youth are no longer navigating temporary unemployment; they are navigating an economy without stable career paths. This dynamic strengthens the generational aspect of the KP economic crisis, where opportunity is decoupled from the province’s economic future.

Global Spotlight on Youth Labor Fragility: Insights for the KP Economic Decline

Tunisia’s youth employment crisis offers a strong comparative lens. According to the African Development Bank, Tunisia’s youth unemployment surpassed 36 percent, with female rates crossing 44 percent, driven by weak private sector absorption and declining industry-linked training. The IMF notes that Tunisia’s NEET rates rose sharply during inflationary cycles, deepening youth frustration and migration aspirations. These trends parallel KP’s youth challenges, where unemployment and skills mismatches are accelerating outward migration and long-term economic vulnerability.

“If youth unemployment continues unchecked, KP will lose an entire generation of skilled workers, weakening its future labor market and intensifying the long-term impact of the economic crisis.”

5: Border Trade Disruptions Intensifying the Khyber Pakhtunkhwa Financial Stress

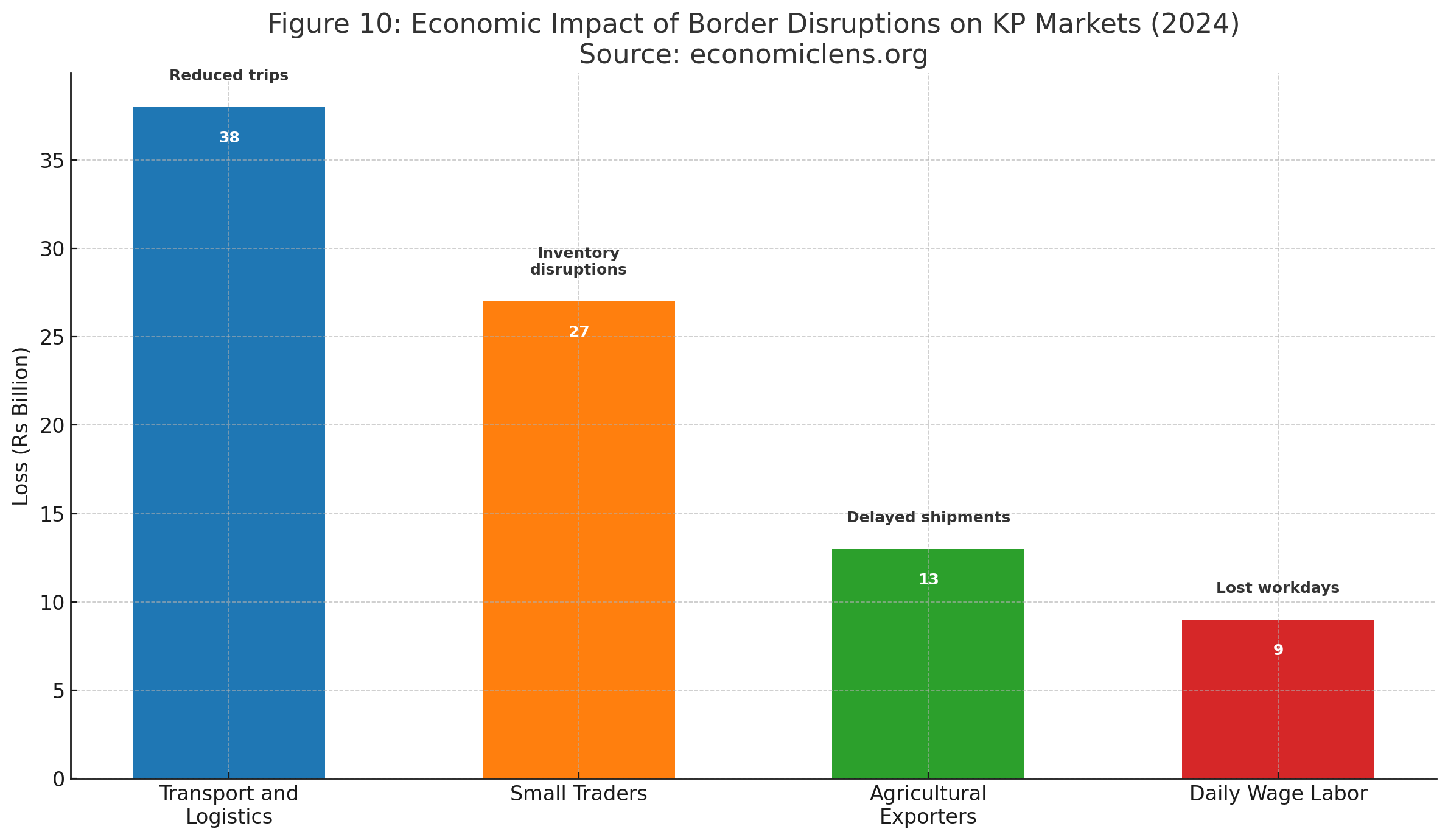

Border closures and trade barriers have emerged as major accelerators of the KP economic crisis. Torkham’s daily truck movement fell from nearly 2,500 trucks to 1,200–1,400, reflecting a sharp decline of almost 48 percent. The ripple effects hit thousands of traders, transporters and local markets, leading to estimated losses exceeding Rs 38 billion for the province’s logistics and trading sectors.

Expert Insights on Trade Volatility and the KP Economic Crisis

UNCTAD’s Border Trade and Market Disruption Analysis (https://unctad.org) warns that border closures in developing economies can reduce regional GDP by up to 1.5 percent annually. KP’s border-driven slowdown is consistent with this global finding.

The World Bank’s Afghanistan Regional Trade Review (https://www.worldbank.org/trade) highlights how instability in cross-border flows increases informal trade, reduces state revenue and amplifies market volatility.

Additionally, the Asian Development Bank’s Regional Supply Chain Report (https://www.adb.org/publications) finds that frequent trade disruptions weaken investment confidence in frontier markets. These global signals reinforce the view that border volatility is a core component of the KP economic crisis, affecting pricing, supply chains and business continuity.

Commentary

Border uncertainty weakens KP’s economic stability. It raises transport costs, limits market access and reduces formal activity. The sharp fall in trade flows forces small traders and transport workers into distress. High inventory costs now threaten business closure for wholesalers and retailers.

Furthermore, weakened cross-border activity reduces the economic lifeline for frontier districts that rely on stable trade for daily income. These disruptions intensify supply shortages, inflate prices and strengthen informal trade networks that bypass regulation. This dynamic deepens the KP economic crisis and destabilizes the province’s market ecosystem.

Global Spotlight on Trade Disruptions: Lessons for Khyber Pakhtunkhwa Financial Stress

Ethiopia’s border trade disruptions offer a direct global parallel. According to UNCTAD, Ethiopia experienced a significant decline in cross-border trade volume due to conflict spillovers and customs instability, leading to estimated losses of over 1.2 percent of national GDP. Local markets became volatile as logistics disruptions increased costs and reduced availability of essential goods. Similar to KP, traders in Ethiopia turned increasingly toward informal channels to survive the downturn. This global experience demonstrates how border volatility magnifies internal economic stress and accelerates market collapse.

“If border instability persists, KP’s markets will continue shrinking, supply chains will weaken further and the province will face an economic contraction that becomes increasingly difficult to reverse.”

Policy Pathway: Rebuilding Economic Stability Under the KP Economic Crisis

Stabilization Measures for the KP Economic Crisis

KP’s path out of the economic crisis requires more than incremental policy adjustments. It demands a structural reset that directly addresses poverty, corruption, joblessness and border volatility. Social protection must shift from token assistance to full-scale coverage that reaches vulnerable households in rural and merged districts. Targeted cash transfers, nutrition programs and school stipends can immediately stabilize consumption for families facing extreme deprivation.

Governance Reforms to Reduce Khyber Pakhtunkhwa Financial Stress

Second, KP must implement strict transparency standards in procurement and local government financing. Independent audits, digital tracking of projects and real-time public expenditure dashboards can reduce the Rs 176 to 200 billion in annual leakages that drain the development budget.

Trade and Market Recovery Strategies for the Economic Crisis in KP

Third, border management requires coordinated regulation between customs, security forces and trade associations to stabilize the Torkham corridor and revive daily trade flow.

Human Capital Solutions to Reverse KP Economic Decline

Fourth, KP needs an aggressive expansion of technical and vocational training tied to private-sector demand. Reforms in TVET must link young people to digital, industrial and service-sector opportunities that reflect modern economic trends. Finally, women’s economic participation must become an economic priority, not a policy afterthought, since raising female labor participation would significantly expand household incomes and provincial productivity.

“If KP fails to pursue deep structural reforms now, the economic crisis will solidify into a long-term poverty trap that locks millions out of opportunity. The province stands at a turning point, and the decisions taken today will determine whether the next decade becomes one of recovery or irreversible decline.”

Conclusion: Conclusion: Long-Term Risks of the Worsening KP Economic Crisis

The KP economic crisis has evolved into a multidimensional breakdown that reshapes how families survive, how markets function and how institutions operate. Poverty has surged, corruption pressures hollow public services, youth unemployment intensifies social fragility and border instability undermines the province’s trading backbone. Every indicator points toward a deepening emergency that requires immediate and coordinated intervention.

Moreover, global evidence shows that regions facing simultaneous shocks in inflation, governance and trade seldom recover without decisive structural action. KP is now at that junction. The widening deprivation, collapsing purchasing power and weakening markets are not temporary symptoms. They are structural shifts that will define the province’s future if left unaddressed.

The economic model that once sustained KP is no longer viable. A new strategy must confront fiscal leakages, invest in human capital, stabilize border flows and restore institutional credibility. Only then can KP escape the gravitational pull of prolonged economic stagnation.

19 thoughts on “KP Economic Crisis: Poverty, Corruption Pressures and Financial Strain”

Great job sir

Good Work 👏👏

Informative blog

very good blog for every one

Good work

Thanks for your hardwork.

It include very useful knowledge ,amazing analysis etc.

Outstanding work.

Great sir 👏

Very informative.

Great work

Great for our knowledge that this website help to know our government crisis.think you for all.

Good luck 🤞

The conclusion clearly highlights how serious and multidimensional the economic crisis in KP has become. It’s alarming to see rising poverty, increasing unemployment, weak institutions, and deepening corruption all happening at the same time. These issues are not only destroying economic stability but also putting the social fabric of the province at risk. The situation demands urgent and coordinated action from policymakers, institutions, and community leaders. Ignoring these warning signs will only push KP toward further instability. This analysis is a powerful reminder that without timely intervention, the long-term consequences could be even more damaging for future generations.

Excellent

I live in kp but I didn’t know the things were that bad.

Great

Good Work 👏👏

Reply

Good job

Impressive Work ❤️